After opening the shortened U.S. trading week with successive declines, the S&P 500 Index rallied on Thursday and Friday to not only erase this year’s losses but also to close at an all-time high, as investors returned to buying equities in force. The broad market index rose 1.23% on Friday to settle at 4,839, surpassing both the prior record intraday and closing highs from January 2022.

Following a 19% loss in 2022, the S&P 500 roared back in 2023, posting a 24% gain as the economy skirted the recession that many had expected, and inflation came down to levels that allowed the Federal Reserve to pause its interest rate hikes. The benchmark came close to reaching a record following a forceful fourth-quarter rally, but ultimately fell short. Friday’s milestone confirms that the stock market is officially in a bull market that began in October 2022, and not just a bounce within a bear market. The S&P 500 is up more than 35% since that low1.

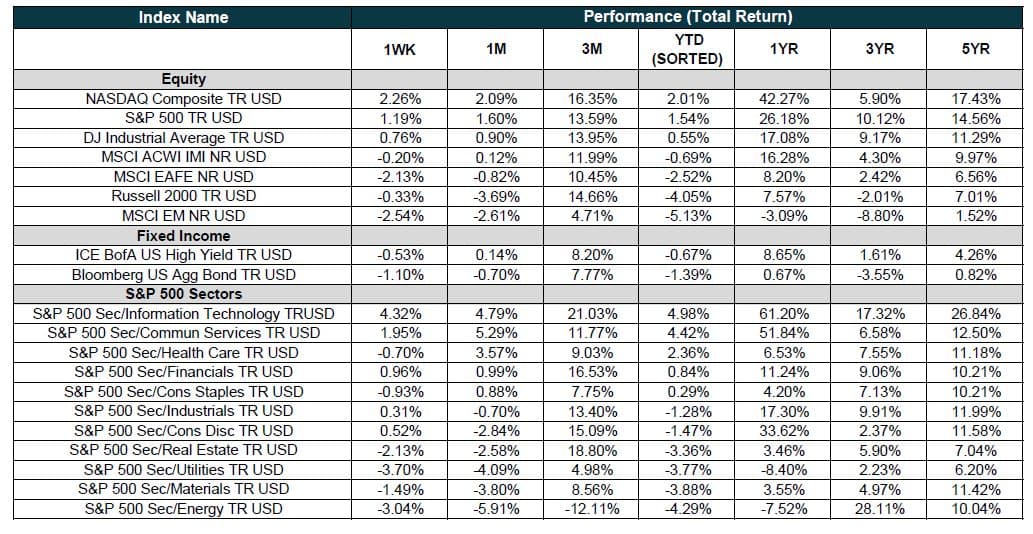

For the week, the S&P 500 Index rose 1.19% while the Dow Jones Industrial Average advanced 0.76%2. However, positive sentiment around technology stocks, partly driven by Bank of America upgrading Apple to a buy rating, saw the NASDAQ rise 2.26%.2.

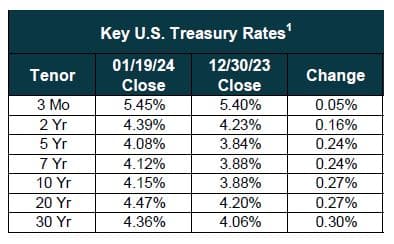

Fixed income markets declined, with the key Bloomberg US Aggregate Bond index falling 1.10%2 as the US 10-year Treasury bond rose 19bps for the week, to close at 4.15%3. The rise in interest rates came after Federal Reserve Governor Christopher Waller remarked “I see no reason to move as quickly or cut as rapidly as in the past”4, suggesting that easier monetary policy may come more slowly than anticipated.

Last week was also dominated by Q4 corporate earnings, primarily from financial institutions. Goldman Sachs reported strong earnings driven largely by impressive results in their asset and wealth management divisions, while Morgan Stanley’s profit dropped due to one-time charges tied to a Federal Deposit Insurance Corporation’s (FDIC) special assessment and a legal matter. The results compared with fellow Wall Street giants that reported lower profits the previous week, clouded by special charges and job cuts.

Two key pieces of economic data released during the week underpinned the strength of the consumer and the labor markets. The Department of Commerce reported that retail sales data for December came in stronger than expected, indicating a resilient consumer, and putting aggressive rate cuts from the Federal Reserve into doubt. Retail sales were up 0.6% from November, and gained 0.4% month over month ex-autos. Economists polled by Dow Jones had estimated a 0.4% month-over-month increase in retail sales and 0.2% ex autos5. Data released by the Department of Labor indicated that initial jobless claims fell 16,000 to 187,000 in the week ended January 13, below the consensus forecast for a rise to 207,000. Claims are at their lowest level since September 2022 when they were 182,0006.

The Federal Reserve meets on January 30-31, but traders are looking further ahead to the March meeting and are pricing in a 46% chance of an interest rate cut, down from over 70% just a month ago, according to CME Group’s FedWatch tool7.

Sources:

- https://www.cnbc.com/2024/01/18/stock-market-today-live-updates.html

- Morningstar Direct

- https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202401

- https://www.federalreserve.gov/newsevents/speech/waller20240116a.htm

- https://www.cnbc.com/2024/01/17/retail-sales-december-2023.html

- https://www.dol.gov/ui/data.pdf

- https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

Market Rebound Attempt Fails