Markets End Wild Week on an Exuberant Note

by Sequoia Financial Group

by Sequoia Financial Group

Last week was a jam-packed one, with Q4 earnings reports, inflation and employment data releases, and the first Federal Reserve meeting of 2024. Nearly 20% of the S&P 500 reported Q4 results, including five – Microsoft, Apple, Alphabet, Amazon, and Meta – of the so-called “Magnificent Seven”. Stocks moved higher on Monday, hitting a record in anticipation of positive earnings and economic news, before drifting slightly lower Tuesday.[1]

The real action started after markets closed on Tuesday when Microsoft announced strong earnings and revenue growth. Revenue grew 18% while net income increased 33%, thanks in part to strong AI demand. Microsoft ended the week at an all-time high. Alphabet’s results weren’t quite as robust. While its overall revenue and earnings beat analyst estimates, advertising revenue came in a little shy of expectations. The shortfall dragged the stock down 7% on Wednesday.[2]

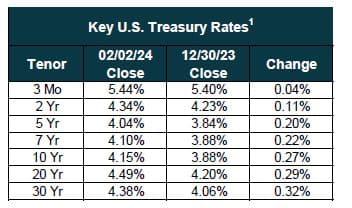

Alphabet weighed heavily on the market, but Fed Chairman Powell added to the negative sentiment by talking down the possibility of an interest rate cut in March. He argued that the FOMC would be unlikely to reach a high enough level of confidence by the March meeting that inflation was under control.2 Following his announcement, the odds of a rate cut in March dropped to just 20%. In early January, those same odds stood at more than 70%.[3] The major market averages, all anticipating lower interest rates sooner rather than later, suffered their worst day of the year thus far.

Thankfully, the sour mood didn’t last long and markets roared back on Thursday. Continuing jobless claims climbed slightly, pointing to a cooling labor market and supporting the soft economic landing scenario that has lifted stocks higher in recent weeks. The market also rallied in anticipation of positive earnings results from Apple, Amazon, and Meta.[4] Regional banks, however, slumped after New York Community Bank posted a loss and reduced its dividend. The institution blamed regulatory standards that kicked in following its purchase of Flagstar Bank and certain assets and liabilities of troubled Signature Bank.[5] But whether its issues are isolated remains to be seen.

The rally continued on Friday thanks to huge earnings surprises by Amazon and Meta, and a stunning January jobs report. Meta rallied more than 20% after blowing away analyst revenue estimates, announcing a $50 billion share buyback, and initiating a quarterly dividend. Amazon, meanwhile, enjoyed a record-breaking holiday season to close out 2023, and projected Q1 sales growth of 8-13%. On the economic front, the jobs market added more than 350,000 jobs in January, crushing analyst estimates of 185,000.[6] The S&P 500 climbed for the fourth week in a row, closing at a record level and setting the stage for a positive 2024.

[1] https://www.cnbc.com/2024/01/28/stock-futures-fall-ahead-of-big-tech-earnings-and-fed-meeting-decision-live-updates.html

[2] https://www.cnbc.com/2024/01/30/stock-market-today-live-updates.html

[3] https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html?redirect=/trading/interest-rates/countdown-to-fomc.html

[4] https://www.cnbc.com/2024/01/31/stock-market-today-live-updates.html

[5] https://ir.mynycb.com/news-and-events/news-releases/press-release-details/2024/NEW-YORK-COMMUNITY-BANCORP-INC.-REPORTS-RECORD-RESULTS-FOR-2023/default.aspx

[6] https://www.cnbc.com/2024/02/01/stock-market-today-live-updates.html

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

Stocks Extend Rally on Trade and Earnings Positives