Financial Aid 201: The FAFSA Application Process

by Sequoia Financial Group

by Sequoia Financial Group

It’s that time again; your student is asking for tax documents, records of untaxed income, and details on your investments. Have they taken a sudden interest in finance? Maybe. More likely, it’s time to fill out the Free Application for Federal Student Aid (FAFSA)[1] paperwork.

With the cost of college, universities, and career schools ballooning (by 180% in the past 30 years), financial assistance is necessary for most students. In fact, 70% of full-time, first-year undergraduate students in 2021-2022 were awarded some financial aid[2].

Completing the FAFSA form is the first step toward getting federal aid to help pay for college, career school, or graduate school. But where do you begin? What do you need? And when do you need it completed? Read on for a step-by-step guide through the FAFSA process.

What’s New in the 2024-2025 FAFSA Form?

- “Contributor” is a new term on the 2024-25 FAFSA form. It refers to anyone (you, your spouse, your biological or adoptive parent, or your parent’s spouse) who’s asked to provide their information, consent, and approval to have their federal tax information transferred automatically from the IRS into the FAFSA form, and signature on your FAFSA form. (Note: Unless they’ve legally adopted you, your grandparents, foster parents, legal guardians, siblings, aunts, and uncles aren’t considered contributors, even if they helped provide for or raise you.)

- Your federal tax information can be transferred directly from the IRS into the FAFSA form. This information is used to determine eligibility for financial aid.

- The student and contributors must consent to and approve the transfer of federal tax information into the FAFSA form, which is required to be eligible for federal student aid.

- The Student and contributors must each have a StudentAid.gov[3] account and Federal Student Aid ID (FSA ID).

- You can view the progress of your FAFSA form and more in your StudentAid.gov account.

- When you’ve completed the online FAFSA form, your information can be sent to up to 20 colleges, career schools, or trade schools.

What Documents Do I Need?

Like most financial documents, you’ll need to compile several files to fill out the FAFSA form. Take a minute to review and collect these essentials:

- The student’s Social Security number and the parent’s Social Security numbers for a dependent student

- The student’s driver’s license number (if the student has one)

- The student’s Alien Registration number (if the student is not a U.S. citizen)

- Federal tax information or tax returns (IRS 1040), including IRS W-2 information as well as foreign tax returns, for the student (and their spouse, if married) and for the parents of a dependent student

- Records of untaxed income, such as child support received, interest income, and veterans’ non-education benefits for the student and the parents of a dependent student

- Information on cash; savings and checking account balances; investments, including stocks and bonds and real estate but not including the home in which you live; and business and farm assets (only if more than 100 full-time employees) for the student, as well as the parents of a dependent student.

Beginning with the 2017–18 FAFSA, income and tax information from an earlier tax year were required to be reported. If you have not filed your taxes by the time you fill out your FAFSA, you may estimate the income amounts.

If your income has changed drastically since last year’s tax return, click “Income Estimator” on the FAFSA page to ask for income information. The Income Estimator will help you estimate adjusted gross income (AGI). After you file your taxes, you must log back into the FAFSA and correct any estimated wrong information.

If you have filed your taxes before filling out your FAFSA, consider the option inside the FAFSA called the IRS Data Retrieval Tool (IRS DRT). The IRS DRT takes you to the IRS website, where you log in by providing your name and other information exactly as you provided on your tax return.

At the IRS site, you can preview your data before agreeing to have it transferred to your FAFSA. When you return to the FAFSA, you will see that questions populated with tax information will be marked with “Transferred from the IRS.” Do not change those answers (except where Individual Retirement Account or pension rollovers are involved), or you will invalidate the information you retrieved.

Whose Information Do I Report?

The FAFSA form asks questions determining whether a student is dependent or independent when applying for federal student aid. If the response to all the questions is no, the student is considered a dependent. If any questions receive an affirmative response, the student is considered independent. A dependent student must report

parent information, as well as their information on the FAFSA application.

If you need to report parent information, here are some guidelines to help you:

- If the student’s legal parents (biological and/or adoptive) are married to each other, answer the questions about both, regardless of whether they are of the same or opposite sex.

- If the student’s legal parents are not married to each other and live together, answer the questions about both, regardless of whether they are of the same or opposite sex.

- If the student’s parent is widowed or was never married, answer the questions about that parent.

If the student’s parents are divorced or separated, how the FAFSA is completed depends on whether they live together.

- If the student’s parents are divorced or separated and do not live together, answer the questions about the parent who provided more financial support during the past 12 months or during the most recent 12 months that the student received support from a parent.

- If divorced parents live together, indicate their marital status as “Unmarried and both parents living together” and answer questions about both on the FAFSA.

- If separated parents live together, you’ll indicate their marital status as “Married or remarried” (NOT “Divorced or separated”) and answer questions about both on the FAFSA.

If the student has a stepparent married to the legal parent whose information is being reported, you must also provide information about that stepparent. It does not matter if the student does not live with their parent or parents; you still must report information about them. The following people are not deemed parents unless they have adopted the student: grandparents, foster parents, legal guardians, older brothers or sisters, and uncles or aunts.

Your Federal Student Aid ID (FSA ID)

You will need to create an FSA ID to submit your FAFSA electronically. You can get your FSA ID as you fill out the FAFSA, but you also have the option to get it ahead of time. Getting an FSA ID before you begin the FAFSA could reduce delays due to processing time.

If you are a parent/contributor of a dependent student, you will need your own FSA ID to sign your child’s FAFSA electronically. If you have more than one child attending college, you can use the same FSA ID to sign all their applications.

“Contributor” is a new term on the 2024-25 FAFSA form. It refers to anyone (you, your spouse, your biological or adoptive parent, or your parent’s spouse) who’s asked to provide their information, consent, and approval to have their federal tax information transferred automatically from the IRS into the FAFSA form, and signature on your FAFSA form. (Note: Unless they’ve legally adopted you, your grandparents, foster parents, legal guardians, siblings, aunts, and uncles aren’t considered contributors, even if they helped provide for or raise you.)

To access the FAFSA form, you’ll need to:

- Login at StudentAid.gov

- You will need to create a username and password, as well as

- You’ll need to provide answers to potential challenge questions to get your account information if you forget it.

- You have to provide your email address or mobile phone number (email address or mobile phone number can be used with only one FSA ID)

If you don’t already have an account, you and your contributors must create your own StudentAid.gov account to access the FAFSA form, provide consent and approval, and sign and submit the form.

When you first apply for your FSA ID, it is conditional until your information is verified with the Social Security Administration (SSA). You may sign your online FAFSA with it, but nothing else. Once your information is verified with the SSA (one to three days from the date you apply), you can use your FSA ID to access your personal information on any of several federal student aid websites.

Starting Your FAFSA Form

If you are starting a FAFSA for the first time, go to https://studentaid.gov/h/apply-for-aid and click “Start New Form.”

As you begin, keep the following in mind:

- Your name and Social Security number must match those on your Social Security card.

- If you are concerned about providing personal information on the login page, choose the virtual keyboard option for additional security.

- The password you create near the beginning of the application is different from your FSA ID. You will need the password only if you start your FAFSA, save it without finishing it, and want to open it again later to finish it.

- If you are applying for a summer session, you can contact the financial aid office at your college to find out which school year you should select when you complete your FAFSA.

If you filled out a FAFSA last year and want to renew it, select “Start or Edit a 2023-24 FAFSA Form”. Many of the nonfinancial questions will then be pre-filled for you; however, update any information that has changed since last year.

Listing Schools to Receive Your Information

While completing the FAFSA, you must list at least one college that will receive your information. The schools you list will use your FAFSA information to determine the types and amounts of aid you may receive.

For federal student aid purposes, it does not matter in what order you list the schools. However, several states require you to list a state school first to be considered for state aid. Therefore, if you plan to list a state school in your state of residence as one of the schools in this section, you should list it first. After the first school, you may list additional schools in alphabetical order.

You can now list up to 20 schools on the online FAFSA (10 on the FAFSA PDF version) or up to 4 schools on a paper FAFSA and may add more schools to your FAFSA later. Schools you list on your FAFSA will automatically receive your FAFSA results electronically.

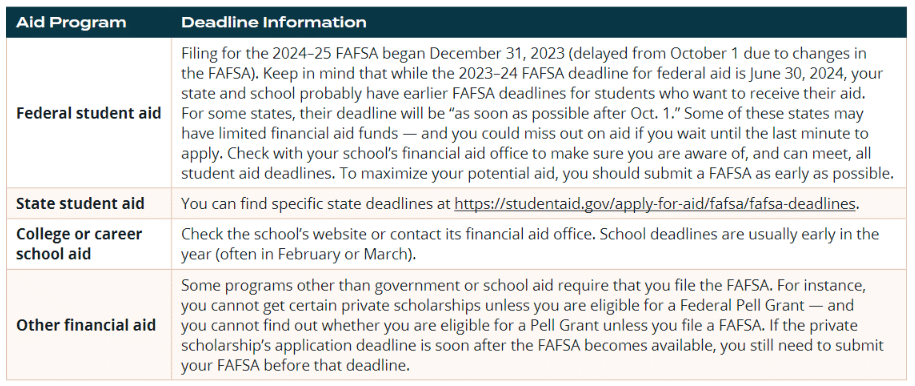

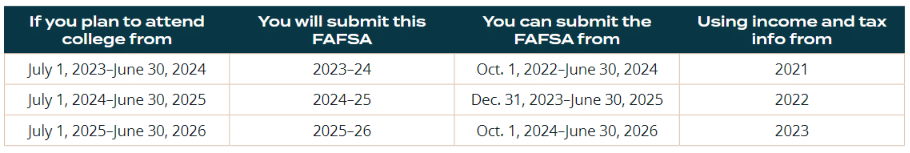

When and How To Fill Out The FAFSA

The FAFSA is generally available on October 1st of each year, and different programs have different deadlines. You must fill out the FAFSA every year you’re in school to stay eligible for federal student aid. To ensure you don’t miss any deadlines, fill out the FAFSA as soon as it becomes available.

The FAFSA deadline is June 30 every year. However, if you have already submitted your FAFSA and want to make corrections or updates, you have until September 9th of the same year.

The Many Ways to File

- Online at https://studentaid.gov/h/apply-for-aid/fafsa.

- Using the myStudentAid mobile app.

- Download a FAFSA PDF.

- Request a printout of the FAFSA PDF by calling 1-800-433-3243. You can file it there. Some schools will use special software to submit your FAFSA for you or 334-523-2691.

- Ask the financial aid office at your college or career school if you can file it there. Some schools will use special software to submit your FAFSA for you.

Conclusion

Like any critical financial document, compiling all the parts, ensuring correctness, filing out, and finally sending the FAFSA form can feel overwhelming. Luckily, the advancement of technology means that much of the information needed to fill out the FAFSA form can be imported from the IRS. If you’re still feeling a little overwhelmed, or you simply want another set of eyes to ensure your fillings are correct, don’t hesitate to contact Sequoia Financial.

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

Market Rebound Attempt Fails