Equities Hit New Highs on Big Tech Momentum

by Sequoia Financial Group

by Sequoia Financial Group

U.S. equities closed mostly higher in a quiet session on Monday. Big Tech stocks, led by Tesla, Apple, and Amazon, continued to drive gains. The June ISM Manufacturing PMI fell to 48.5, its lowest level since February, missing estimates of 49.1.1 The Prices Paid Index (down to 52.1) weakened and the New Orders Index (up to 49.3) improved but remained in contraction territory. 1 The report highlighted declining demand and output, confirming a manufacturing slowdown at the end of Q2. 1

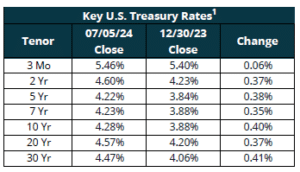

On Tuesday, U.S. equities closed higher again, ending near their session highs. Big Tech remained the leader, with Tesla the standout gainer. Novo Nordisk and Eli Lilly lagged after facing pressure from President Biden’s call for lower prices on diabetes and weight-loss drugs.2 Treasury rates stabilized after rising due to increased odds of a Republican sweep in the upcoming elections. Fed Chairman Powell, speaking at an ECB panel in Portugal, acknowledged progress on inflation but emphasized the need to confirm the trend’s sustainability.3 May JOLTS job openings came in higher than expected at 8.14 million, but April’s data was revised lower to 7.919M from 8.059M.4

Wednesday saw U.S. equities continue their ascent, with the S&P 500 and NASDAQ Composite reaching new record closing highs. Big Tech, particularly Tesla and Nvidia, along with the semiconductor sector, led the rally. Notably, the market continued to climb despite both weak economic data (June ISM Services PMI fell to 48.8, back in contraction territory) and a lack of broad participation.5 Services New orders fell to 47.3 from 54.1 and the employment index came in at 46.1, contracting for the sixth time in seven months. Respondents reported flat or declining business activity.5 While inflation showed signs of easing, some commodities remained significantly higher. 5 June ADP private payrolls missed estimates at 150,000, marking the third consecutive month of deceleration.6 Most new jobs came from construction, leisure/hospitality, and professional/business services. Annual wage growth slowed to 4.9%, the weakest pace since August 2021. 6

Markets were closed on Thursday for the U.S. Independence Day holiday.

Markets closed higher again on Friday, ending near session highs. Despite a softer-than-expected June nonfarm payrolls report (206,000 new jobs, beating estimates but with significant downward revisions to prior months), the market shrugged off the news. June nonfarm payrolls increased 206K ahead of estimates of 190K.7 However, May was revised lower to 218K from 272K and April was revised lower to 108K from 165K.7 The unemployment rate ticked up to 4.1% due to an increase in participation. 7 Government and healthcare sectors fueled job growth, while retail and business/professional services saw contraction. 7

Sources

- https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/june/

- https://www.bloomberg.com/news/articles/2024-07-02/novo-lilly-slip-as-biden-demands-glp-1-drug-price-cuts

- https://www.bloomberg.com/news/articles/2024-07-02/fed-s-powell-ecb-s-lagarde-brazil-s-campos-neto-at-ecb-forum-key-takeaways?embedded-checkout=true

- https://www.bls.gov/news.release/jolts.nr0.htm

- https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/services/june/

- https://adp-ri-nrip-static.adp.com/artifacts/us_ner/20240703/ADP_NATIONAL_EMPLOYMENT_REPORT_Press_Release_2024_06%20FINAL.pdf?_ga=2.65826534.998728812.1720384663-18270983.1720384663

- https://www.bls.gov/news.release/empsit.nr0.htm

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

Muted Inflation Report Pushes Stocks to New Heights