Weak Earnings Reports and Mixed Economic Data Result in a Rise in Volatility

by Sequoia Financial Group

by Sequoia Financial Group

Weak earnings reports from technology stocks and mixed economic data resulted in a rise in volatility, while a rotation out of growth stocks into value stocks and small-caps highlighted last week’s market action.

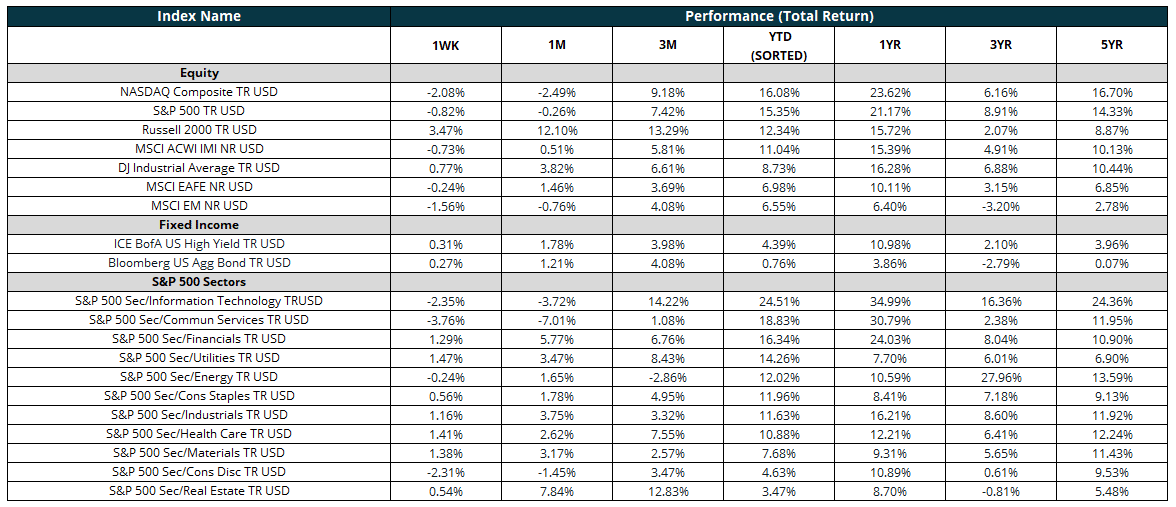

For the week, the Nasdaq and the S&P 500 fell -2.08% and –0.82%, respectively, given their higher allocations to the technology sector.The rotation into value and small-cap stocks saw the Russell 1000 Value index rise by 1.23% and the Russell 2000 index advance by 3.46%1. During the week, the VIX, the volatility index, rose to 18, a level not seen since April. 2

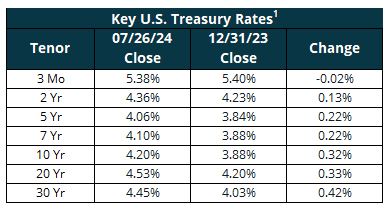

In the fixed-income markets, the Bloomberg U.S. Agg Bond rose 0.27%1 for the week as the 10-year U.S. Treasury Bond ended the week at 4.25%3, a decline of 5 bps from the previous week.

The much-observed rotation out of mega-cap and large-cap stocks into small-and mid-cap companies is only part of the market’s turn this month, as value stocks are suddenly beating growth stocks, too. For the month, iShares Russell 1000 Value ETF is higher by 4.31%, while iShares Russell 1000 Growth ETF is down 3.12%, a delta of 743 bps4.

As corporate earnings season continues, Tuesday saw shares of the Netherlands-based semiconductor company NXP Semiconductors drop 7% as second-quarter earnings missed analysts’ estimates and the company shared weaker-than-expected guidance for the current quarter5. Weakness in their automotive sector weighed on similarly positioned semiconductor companies such as Analog Devices and OnSemi.

Before Wednesday’s market open, mega-cap tech companies Alphabet and Tesla also reported earnings. Despite reporting a top and bottom-line beat, Google’s parent company, Alphabet, declined as YouTube advertising revenue fell below the consensus estimate. Meanwhile, Tesla shares declined on weaker-than-expected results and a 7% year-over-year drop in auto revenue. Other mega-cap tech stocks fell in sympathy with Alphabet and Tesla, including Nvidia, Meta Platforms, and Microsoft6. The Tesla and Alphabet induced sell-off dragged the Nasdaq Composite lower by 3.64% for its worst one-day decline since Oct. 25, 2023, when it shed 2.4%6.

Adding to investor concerns on Wednesday was the release of weaker-than-expected U.S. manufacturing data. The U.S. PMI flash manufacturing output index fell to 49.5 in July, unexpectedly slipping into contraction territory as new orders, production, and inventories declined. Economists had forecast a reading of 51.5, according to Dow Jones6. A housing data report also showed that new home sales came in lighter than economists had expected for June6.

On Thursday, equity markets attempted to rally following the release of a preliminary second-quarter GDP report that showed the economy growing 2.8%, much more than expected due to strong consumer spending on both goods and services. Economists surveyed by Dow Jones had anticipated growth of 2.1%7. As the day progressed, technology stocks continued their decline as investor capital fueled a rise in small caps.

Wall Street closed the week with a rally following the release of June’s personal consumption expenditures price index, an inflation reading preferred by central bank policymakers. On a monthly basis, headline PCE rose 0.1% and 2.5% from a year ago. That was in line with estimates from economists polled by Dow Jones8. Friday’s moves stem from a combination of oversold sentiment, a stronger-than-expected GDP report Thursday, and the view that the Federal Reserve will begin cutting rates due to economic resilience, said CFRA Research’s Sam Stovall9.

Sources:

- Morningstar Direct

- https://www.cnbc.com/quotes/VIX?qsearchterm=VIX

- https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202407

- https://www.cnbc.com/2024/07/24/stock-market-today-live-updates.html

- https://www.cnbc.com/2024/07/22/stock-market-today-live-updates.html

- https://www.cnbc.com/2024/07/23/stock-market-today-live-updates.html

- https://www.bea.gov/news/2024/gross-domestic-product-second-quarter-2024-advance-estimate

- https://www.bea.gov/news/2024/personal-income-and-outlays-june-2024

- https://www.cnbc.com/2024/07/25/stock-market-today-live-updates.html

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

Fed Rate Cut Pushes Stock Benchmarks to Fresh Highs