Summer Swoon Continues Despite Positive Words from Fed

by Sequoia Financial Group

by Sequoia Financial Group

Last week was jam-packed with events that could potentially move markets. Strong earnings reports from Magnificent Seven members Microsoft, Apple, Amazon, and Meta could reverse recent losses in the tech sector. A positive Federal Reserve meeting could solidify the market’s belief that interest-rate cuts would begin in September. And a steady jobs report could provide support for the so-called Goldilocks economy, in which growth continues at a pace that avoids recession, but not so fast as to push inflation higher. So, what actually transpired?

Microsoft led things off for big tech, after the market closed on Tuesday. Expectations didn’t look high, as Microsoft and other tech names sold off Tuesday prior to the earnings release. And the concern was justified. Microsoft’s overall report largely met analyst estimates, but cloud revenue failed to impress, and the stock moved lower.[1] The report put added pressure on Apple, Amazon, and Meta to give a much-needed lift to the sector.

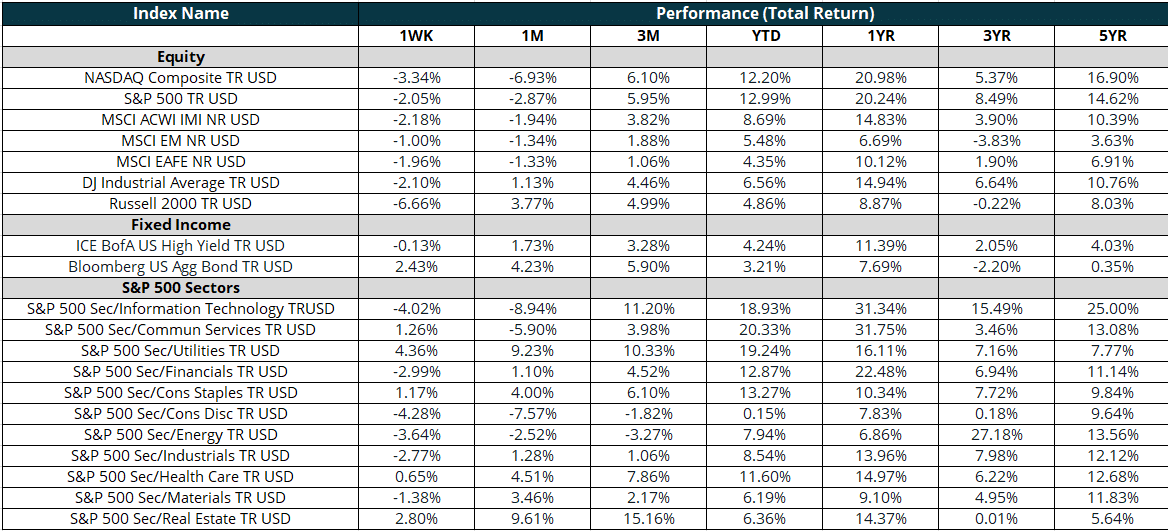

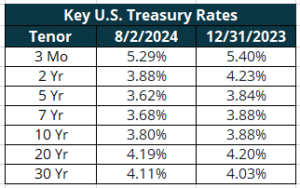

Federal Reserve Chairman Powell provided some needed relief to the overall market on Wednesday with his announcement that an interest rate cut was on the table for September.1 Bond and stock prices jumped on the news, with the S&P 500 enjoying its best day since February, and the bond market moving comfortably into positive territory year to date after languishing in the red for much of the year. Meta capped off the strong day by beating earnings estimates and issuing positive guidance.[2] The stock jumped 7% following the report, setting the stage for a strong finish to the week.

But while bonds improved on their gains, stocks failed to hold theirs. Apple delivered a strong quarterly report after hours on Thursday, but Amazon disappointed.[3] And on the economic front, initial jobless claims spiked and manufacturing activity cooled, raising fears that the Fed’s telegraphed rate cut would come too late to stave off a recession.[4] A second weak jobs report on Friday added to recession fears and kept buyers on the sidelines.3 When the closing bell sounded on Friday afternoon, the S&P 500 had suffered its third down week in a row. Meanwhile, the tech-heavy NASDAQ had entered correction territory, sliding more than 10% from its June high.

The sell-off continued Monday morning, with stocks moving sharply lower. Indeed, the Dow slumped more than 1,000 points, while the Nasdaq slid more than 5%. The extreme volatility has even prompted calls for an emergency Fed rate cut[5]. We’ll be tracking developments closely but it’s important to not overreact to market volatility, as impairment to investment portfolios can come more from how investors respond to volatility than from the volatility itself.

[1] https://www.cnbc.com/2024/07/30/stock-market-today-live-updates.html

[2] https://www.cnbc.com/2024/07/31/meta-earnings-q2-2024.html

[3] https://www.cnbc.com/2024/08/01/stock-market-today-live-updates.html

[4] https://www.cnbc.com/2024/07/31/stock-market-today-live-updates.html

[5] https://www.cnbc.com/2024/08/05/whartons-jeremy-siegel-says-fed-needs-to-make-an-emergency-rate-cut.html

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

Major Equity Indices Decline as Post-Election Euphoria Fades