‘The Time Has Come’ for Interest Rate Cuts

by Sequoia Financial Group

by Sequoia Financial Group

Federal Reserve Chairman Jerome Powell laid the groundwork for cutting interest rates in his much-awaited keynote address on Friday at the Fed’s annual retreat in Jackson Hole, Wyoming. While not providing exact indications on timing or magnitude, he said: “The time has come for policy to adjust . . . The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”1

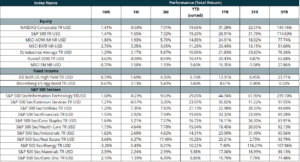

Financial markets responded favorably to Powell’s comments to close the week on an uptrend. With Friday’s gains, the three major averages recorded a winning week despite some choppiness. The S&P 500 rose 1.47%, the NASDAQ advanced 1.41%, while Dow Jones Industrial Average gained 1.29%. However, it was small-cap stocks that benefitted the most, with the Russell 2000 rising 3.62% – they have lagged the major averages on a year-to-date basis and would be likely beneficiaries of lower interest rates.2

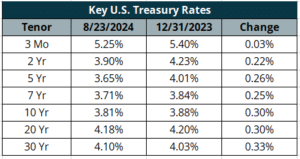

Fixed income markets also advanced as the US 10-year Treasury bond declined 8bps to close the week at 3.81%.3 The Bloomberg US Aggregate Bond Index rose 0.67% for the week.2

The week saw Q2 corporate earnings dominated by retailers, with strong reports from Target and The TJX Companies, while home-improvement giant Lowe’s provided a cautious outlook.

Target reported that sales grew about 3% in its fiscal Q2, a return to growth after a prolonged stretch of sluggish sales and squeezed profits. The discounter beat Wall Street’s earnings and revenue expectations as shoppers made more visits to Target’s stores and website and bought more discretionary items like clothing.4 Discount retailer TJX raised its full-year earnings guidance on Wednesday after posting another quarter of strong sales, but its outlook fell just short of Wall Street’s expectations.5

Meanwhile, on Tuesday, Lowe’s cut its full-year forecast for both sales and earnings, as its quarterly sales declined, and it projected weak home improvement spending in the second half of the year. The retailer’s results echoed sentiments similar to those of rival Home Depot, which also said it expected a weaker second half.6

Economic data out on Friday indicated that new home sales picked up the pace in July, hitting an adjusted annualized rate of 739,000, which is the highest number since May 2023 according to Census Bureau data. The pace of sales was much higher than the 620,000 expected by economists, according to Dow Jones, and above the revised 668,000 number from June. Homebuilder stocks rose on Friday, with the iShares U.S. Home Construction ETF (ITB) up 4.2% and closing at its highest level on record.7

Following Powell’s speech, the probability of a decline in Fed funds futures at the upcoming Federal Reserve meeting on September 18 reached 100%. However, according to the CBOE’s Fed Watch tool, the odds of a 50bps cut had risen to 36%, from 24% prior to Powell’s remarks. The probability of a 25bps cut stood at 64%.8

Note: Performance figures for more than one year are annualized. Performance figures for less than one year are cumulative.

Sources:

1. https://www.cnbc.com/2024/08/23/fed-chair-powell-indicates-interest-rate-cuts-ahead-the-time-has-come-for-policy-to-adjust.html

2. Morningstar Direct

3. https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202408

4. https://www.cnbc.com/2024/08/21/target-tgt-q2-2024-earnings.html

5. https://www.cnbc.com/2024/08/21/tjx-companies-tjx-earnings-q2-2025.html

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

Market Rebound Attempt Fails