Wealth Planning: Protecting Your Assets

by Sequoia Financial Group

by Sequoia Financial Group

At the core of wealth planning is the pursuit of accumulating and retaining sufficient assets that can provide you and your loved ones with a lifetime of living expenses, medical care, and other financial goals. In today’s litigious society, asset protection planning has become an integral aspect of financial and estate planning, intended to reduce the risk of losing these assets through unexpected events. Retaining control and enjoyment over assets while sheltering those assets, to the extent possible, from the claims of creditors is the key focus of these techniques.

There are three basic asset protection techniques: insurance, statutory protection, and asset placement. None of these techniques alone is a complete solution, but it may make sense as one limited component of an asset protection plan.

Insurance

Proper insurance coverage can significantly reduce your risk by shifting some of your risk to an insurance company. Umbrella insurance protects from many personal injury claims above the liability limits set by your homeowners or auto insurance. Business owners should also ensure their companies are adequately insured for liability and property loss. Review your existing coverage and consider purchasing or increasing coverage as appropriate. You should be adequately insured against:

- Death and disability

- Medical risks, including long-term care

- Liability and property loss (both personal and business)

- Other business losses

If you are expecting an inheritance, you may want to speak with the person leaving you the inheritance to suggest that it be left in trust rather than receiving it outright. If an inheritance is left outright, it will be exposed to existing creditors and may remain exposed to potential future creditors. Conversely, an inheritance received in trust could be shielded from creditors and free from future estate tax for the portion not consumed, so long as you properly structure the trust.

Statutory Protection

An additional basic asset protection strategy is maximizing the use of generally exempt assets when satisfying the claims of a judgment creditor. Creditors cannot enforce a lien or judgment against property exempt under federal or state law. While exemption planning cannot offer total protection, it can offer some shelter for certain assets.

Both federal and state laws govern whether property is exempt or nonexempt in non-bankruptcy proceedings. When looking at exemption laws, be sure to find out how much of an exemption is allowed for a particular type of property, as it may be completely exempt, exempt only up to a certain amount, or restricted in some way.

For instance, your interest in an IRA (Individual Retirement Account) or Roth IRA is exempt from creditors in many states. This does not typically include inherited IRAs unless specifically protected under state law. Qualified pension plans are generally exempt from ERISA (Employee Retirement Income Security Act). Therefore, your retirement plan at work should be exempt from creditors until you retire and begin withdrawals from the account. Also, life insurance and annuity contracts typically enjoy an unlimited exemption from creditors in many states.

In certain states, a husband and wife should own their joint property as tenants by the entirety and not as joint tenants with rights of survivorship, assuming their goal is to protect their assets during their lifetime. The creditors of just one spouse cannot reach property held as tenants by the entirety, but they can get assets held in other forms of joint ownership. Therefore, to prove your intention to own property as tenants, you should speak with counsel to sign a tenancy by the entire agreement.

Asset Placement

Asset placement refers to transferring legal ownership of assets to other persons or entities, such as corporations, limited partnerships, and trusts. The basis for this technique is simple – creditors cannot reach property that you do not own or control.

Repositioning assets to make it legally difficult for potential future creditors to reach them does not extend to actions that hide assets or defraud creditors. If a court finds that your asset protection plans were made with the intent to defraud, it will disregard those plans and make the assets available to creditors.

To avoid violating fraudulent transfer laws, consider the following guidelines.

- Make sure your plans are made for legitimate business purposes or to accomplish legitimate estate planning objectives

- Carefully document the legitimate business and estate planning purposes of any arrangements you make

- Put your plans into effect before you have any problems with creditors

- Do not implement a plan at a time when a lawsuit is imminent

Separate personal and business assets, intending to separate their respective risks. For instance, by placing business assets in a limited liability company, family limited partnership, or other corporate shell providing personal liability protection, you may be able to shield or veil your assets from business or professional liability litigation.

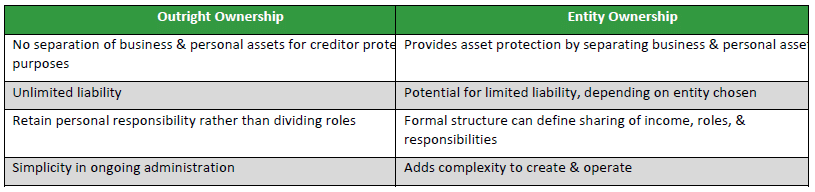

The chart below details items to consider when determining whether or not to establish a business entity.

Although liability protection is desirable for business owners, some businesses cannot achieve it. These businesses are typically professional practices where the owners remain personally liable for their malpractice or negligence under state law.

State law often restricts physicians, attorneys, accountants, and other professionals from forming organizations that would limit their liability for their malpractice. However, many states have created variations of liability protection for professionals to protect them from vicarious liability. These business forms include professional corporations (PCs), limited liability partnerships, and limited liability companies (LLCs).

Balancing assets is a significant tool for married couples to obtain the maximum applicable exclusion amount for each spouse while removing assets from a potential debtor’s estate. Alternatively, it may be more beneficial to title assets in the spouse’s name with less creditor risk. If you have high exposure to potential liability because of your occupation or business, it may be advisable for you to shift assets to your spouse. Your spouse would retain the assets subject to the exposure as his or her separate property, and you would retain assets that enjoy statutory protection, such as the homestead, life insurance, and annuities, as separate property. Furthermore, shifting assets to a spouse or children may help accomplish other estate planning goals.

To avoid complications if your marriage ends in divorce, you and your spouse should agree to the division of assets in writing. This is especially important in community property states since property and income are acquired or earned by spouses during their marriage, while domiciled in a community property state, it is considered to have been acquired or earned by both equally regardless of which spouse contributed or earned it, with limited exceptions.

Conclusion

In addition to these basic asset protection strategies, many more sophisticated techniques are available. Potential strategies include Domestic Asset Protection Trusts (DAPT), QTIP trusts (Qualified Terminable Interest Property), Qualified Personal Residence Trusts, Family Limited Partnerships, and spendthrift provisions. If you are interested in further exploring these options, we can assist you in further navigating the asset protection landscape. Contact Sequoia Financial Group today.

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

Disclosure: This material is for informational purposes only and is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Diversification cannot assure profit or guarantee against loss. There is no guarantee that any investment will achieve its objectives, generate positive returns, or avoid losses. Sequoia Financial Advisors, LLC makes no representations or warranties with respect to the accuracy, reliability, or utility of information obtained from third-parties. Certain

assumptions may have been made by these sources in compiling such information, and changes to assumptions may have material impact on the information presented in these materials. Sequoia Financial Advisors, LLC does not provide tax or legal advice. Information about Sequoia can be found within Part 2A of the firm’s Form ADV, which is available at https://adviserinfo.sec.gov/firm/summary/117756

Market Rebound Attempt Fails