Stocks Charge Higher on Tame Inflation Reports

by Sequoia Financial Group

by Sequoia Financial Group

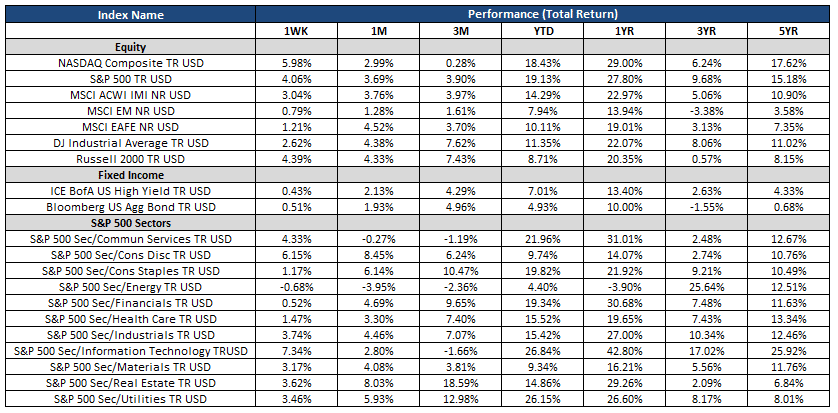

Stocks rebounded last week. The S&P 500 gained 4%, nearly erasing early September’s sizeable losses. The week started strong, with investors finding value in stocks that would likely benefit from expected interest rate cuts.[1] Banks, retailers, and other consumer names moved higher. Technology stocks Palantir and Dell also rallied on news that they will be added to the S&P 500 on September 23. Along with Erie Indemnity, they will replace American Airlines, Etsy, and Bio-Rad Laboratories in the benchmark index.

Stocks continued their move higher on Tuesday, but bank stocks faltered.[2] JP Morgan announced that expectations for its 2025 net interest income were not reasonable. It also pointed to higher-than-anticipated inflation-driven expenses. The stock slipped more than 5% and took other banks down with it, including Citigroup and Bank of America. Oracle had the earnings calendar to itself and it didn’t disappoint – it jumped more than 10% after beating expectations and announcing a new partnership with Amazon.[3]

The big news of the week came on Wednesday and Thursday, with the releases of consumer and producer inflation reports. Annualized consumer inflation (CPI) dipped to just 2.5%, its lowest level since February 2021[4]. Producer price inflation (PPI) showed even more slowing, coming in at just 1.7% for the 12 months ending August 2024.[5] Both measures argue in favor of the Federal Reserve cutting the Fed funds rate at its meeting this week on September 18. The cut would be the first since early 2020.

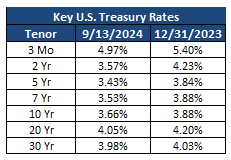

With many stocks again trading near record highs, the bond market has largely been flying under the radar recently. But with interest rates steadily moving lower in recent months, bonds have rallied nicely. The benchmark Bloomberg Aggregate Bond Index has returned roughly 5% since the first of the year and nearly 10% over the last 12 months. Both numbers stand in dramatic contrast to the bond market’s losses in 2021 and 2022.

This week is Fed Week. A rate cut is a near certainty, but there remains disagreement over its size.[6] A quarter percentage point rate cut could look more reactive, while a half percentage point rate cut could look more proactive. Either way, it’s likely the beginning of a string of rate cuts Chairman Powell will push through in his effort to keep the economy on track and inflation in check.

[1] https://www.cnbc.com/2024/09/08/stock-market-today-live-updates.html

[2] https://www.cnbc.com/2024/09/09/stock-market-today-live-updates.html

[3] https://www.cnbc.com/2024/09/09/oracle-orcl-q1-earnings-report-2025.html

[6] https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html?redirect=/trading/interest-rates/countdown-to-fomc.html

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

Stocks Sink as Tariff Fears and Weak Economic Data Shake Investor Confidence