It’s easy to get overwhelmed when selecting healthcare benefits wondering what the best way to save for your care is. Should you opt for an HSA? Or would an FSA be better? Or would a combination of both be best?

Here’s what you need to know about HSAs and FSAs, to help decide which is right for you and your family.

Health Savings Account (HSA)

Health Savings Accounts are accounts established through a qualified HSA trustee like a bank or insurance company to pay for or reimburse certain medical expenses. In order to contribute to an HSA, you must:

- Have coverage under a high-deductible health plan (HDHP) on the first day of the month.

- Not be covered by other health insurance besides the policies covering liabilities incurred under workers’ compensation laws or liabilities related to ownership of property; specific disease coverage; hospitalization policies that pay a fixed daily or other periodic benefit; disability, dental, vision, or long-term care insurance.

- Not be enrolled in Medicare.

- Be ineligible to be claimed as a dependent on someone else’s tax return.

High-deductible health plans (HDHP) have higher annual deductibles than typical health plans, as well as maximum limits on the sum of the annual deductible and out-of-pocket medical expenses that one must pay for covered expenses. For 2024, minimum annual deductions are $1,600 for individual coverage and $3,200 for family plans, and the maximum annual deductible and other out-of-pocket costs are $8,050 and $16,100 respectively. Out-of-pocket expenses include co-payments and other amounts but do not include premiums. The high-deductible requirements are not necessary for preventive care, dental, or vision coverage.

The 2024 HSA contribution limits are $4,150 for individuals and $8,300 for family plans. An additional contribution of $1,000 is permitted for eligible individuals age 55 and over. If one participates in a HDHP for only part of the year, these contributions are prorated based on the months for which coverage was provided under a HDHP. Contributions may be made by both employees and employers, and self-employed or unemployed individuals may also contribute to HSAs. The deadline for contributions is the individual’s tax filing deadline (April 15th of the following year). Contributions are generally not included in income, although different rules apply for partners and shareholder-employees owing 2% or more of an S Corporation.

An HSA is generally tax-exempt, and you are permitted to take distributions at any time; however, only amounts used to pay for qualified medical expenses are tax-free. Expense incurred prior to establishing your HSA are not qualified medical expenses. Earnings on the HSA balance are not included in your income while held in your account, and any remaining account balance is carried over to the next year. If a distribution is not used for qualified medical expenses, you must pay tax on the amount distributed. Additionally, there will be a 20% penalty tax unless you are disabled or over the age of 65. It is the taxpayer’s responsibility to maintain records showing that distributions were used exclusively for qualified medical expenses that were not previously reimbursed from another source or claimed as an itemized deduction.

If you have coverage under a Flexible Spending Arrangement (discussed in further detail below), you may not contribute to an HSA unless the FSA is limited to covering amounts paid for items for which coverage is permitted under other health insurance plans, excluding long term care insurance (Ex., dental, vision). If you are covered by and FSA during its grace period, you may contribute to the HSA if there was a zero balance in your FSA account at the end of the prior year.

Separate HSA contributions can be made for non-dependent adult children who are still in their parents’ HDHP. While the HSA funding maximum is a shared limit between married spouses covered by a family HDHP, non-dependent children can each contribute up to the full maximum amount to their own HSA allowed by the family HDHP plan. Like a 529 or after-tax account, anyone can fund an eligible individual’s HSA. This allows parents to directly fund their child’s HSA for the year, using up to $8,300 of their annual gift exclusion for 2024 to do so. Individuals should fund their own accounts through payroll deductions whenever possible.

Flexible Spending Arrangements (FSA)

Flexible Spending Arrangements (FSAs) are employer-established benefit plans which allow employees to be reimbursed for medical expenses incurred for themselves, their spouses, and their dependents. Self-employed individuals are not eligible to establish an FSA. You do not have to be covered under any particular health care plan to participate.

Contributions are made by electing to voluntarily withhold a portion of your salary for deposit to the FSA. Your employer may also contribute to the plan. You do not pay income or employment taxes on the amounts you or your employer contribute to the FSA, unless the employer contribution provides for long term care insurance. The contribution amount is elected at the beginning of the year and deducted periodically. The election may only be changed if there is a change in your employment or family status. For 2024, employee contributions are limited to $3,200. Certain limitations apply if you are a highly compensated participant or key employee.

Generally, distributions must be made only to reimburse you for qualified medical expenses. You may receive reimbursement equal to the amount you elected to contribute for the year anytime throughout the year, regardless of the amount you have actually contributed. To receive reimbursement, you must provide the FSA with a written statement from a third party, such as a receipt, stating the amount of the expense and that it was actually incurred. You must also provide a written statement that the expense was not reimbursed under any other health coverage. If you are provided with a debit card that meets certain requirements, you may not be required to provide the substantiation information to the FSA. Reimbursements cannot be made for anticipated future expenses.

Flexible spending accounts are generally “use-it-or-lose it” plans, meaning that the account balance cannot be carried over to the next year. The plan may provide for a grace period of up to 2½ months1 after the end of the year. Expenses incurred during the grace period may be reimbursed from amounts left in the account from the previous year. Beginning in 2013, employers are also permitted to allow up to $640 to be carried over to the immediately following plan year. In 2020 new regulations were released allowing the plans (starting in plan year 2020) to adopt an inflation addition to the carry over limits so that 20% of the current contribution rate could can be rolled into the next year. For example, someone participating in an FSA with leftover funds could rollover $640 from the 2024 plan year into the 2025 plan year ($3,200 x 20%). FSAs can offer either the carryover or grace period provision but are not permitted to allow both.

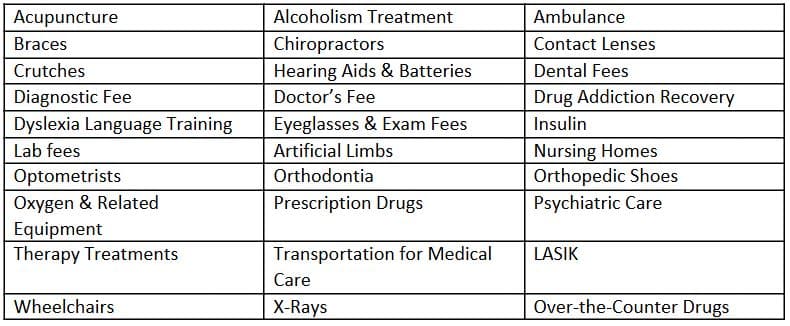

Qualified Medical Expenses

Examples of qualified medical expenses outlined below:

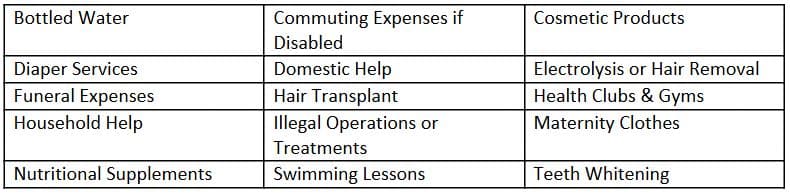

Non-qualified Medical Expenses

Examples of non-qualified medical expenses outlined below:

See IRS Publication 502 for a complete listing of qualified expenses.

Conclusion

Choosing the right way to save for healthcare costs can be challenging. Be sure to weigh each option and consider the pros and cons of each. Both HSAs and FSAs are great options for saving money to pay for qualified medical expenses.

Ultimately, the choice comes down to what’s best for you and your family. Should you need additional information, contact your Sequoia Financial Group advisor.

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

This material is for informational purposes only and is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Diversification cannot assure profit or guarantee against loss. There is no guarantee that any investment will achieve its objectives, generate positive returns, or avoid losses. Sequoia Financial Advisors, LLC makes no representations or warranties with respect to the accuracy, reliability, or utility of information obtained from third- parties. Certain assumptions may have been made by these sources in compiling such information, and changes to assumptions may have material impact on the information presented in these materials. Sequoia Financial Advisors, LLC does not provide tax or legal advice. Information about Sequoia can be found within Part 2A of the firm’s Form ADV, which is available at https://adviserinfo.sec.gov/firm/summary/117756

Markets Soar After 90-Day Tariff Pause