Mixed Reaction to Mag Seven Results and Economic Data

by Sequoia Financial Group

by Sequoia Financial Group

In a volatile week marked by mixed corporate earnings from high-profile Magnificent Seven companies and a raft of economic data US equity markets closed lower for both the week and for the month of October.

Heightened uncertainty ahead of the U.S. presidential election on November 5 raised volatility in the markets. The CBOE Volatility Index (VIX), known as Wall Street’s “fear gauge,” topped 23 on Thursday.1

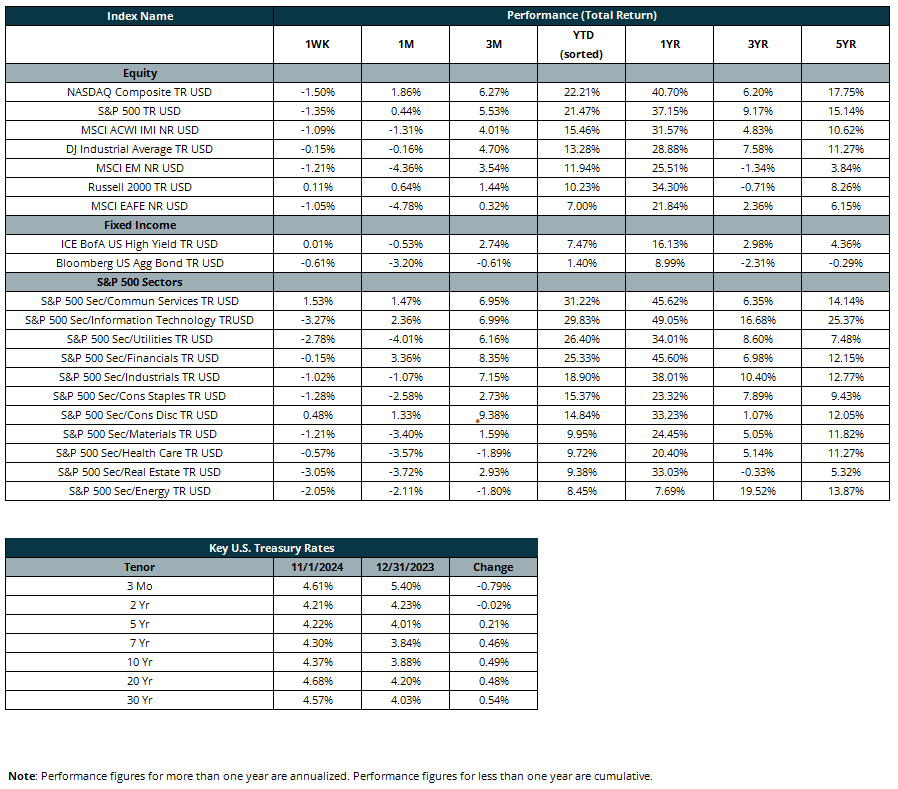

All three major averages posted losses for October, ending a string of monthly gains. For the month, the NASDAQ Composite fell -0.49%, while the S&P 500 Index and the Dow Jones Industrial Average retreated 0.91% and 1.26%, respectively. Small caps trailed, with the Russell 2000 Index falling 1.44%.2

In fixed income markets, the Bloomberg US Aggregate Bond Index fell 2.48% during the month.3 The long end of the yield curve rose as concerns over a slowing economy faded. The US 10-year Treasury bond rose 47bps, closing on Thursday at 4.28%.3

Data released during the week indicated that consumers grew more optimistic about the U.S. economy heading into the contentious presidential election even as job openings hit multi-year lows, according to reports released on Tuesday. The Conference Board’s Consumer Confidence Index for October rose more than 11% to a reading of 138, its biggest one-month acceleration since March 2021. That sentiment was seemingly at odds with a Bureau of Labor Statistics report showing that job openings slid to 7.44 million in September, off more than 400,000 from the previous month’s downwardly revised level, the lowest since January 2021 and below the Wall Street forecast of 8 million.4

On Wednesday, the U.S. economy posted another solid though slightly disappointing period of growth in the third quarter, propelled higher by strong consumer spending that has defied expectations for a slowdown. Gross domestic product, a measure of all the goods and services produced during the three-month period from July through September, increased at a 2.8% annualized rate, below expectations of 3.1%. However, resilient consumer spending, which accounts for about two-thirds of all economic activity, has helped keep the economy moving.5

The latest Personal Consumption Expenditures (PCE) Index, the Federal Reserve’s preferred inflation gauge6, showed 12-month inflation rose at a rate of 2.1% in September, in line with estimates and moving closer to the Fed’s 2% target. Meanwhile, the jobs report released on Friday showed the U.S. economy added just 12,000 jobs in October, far below the Dow Jones estimate of 100,000. This marked the weakest level of job creation since December 2020. The unemployment rate held at 4.1%, in line with estimates. However, traders didn’t react strongly to the job data, believing the dismal data was affected by hurricanes and a Boeing strike.7

Stocks within the Magnificent Seven cohort were both the leaders and laggards of the Dow Jones Industrial Average this week as equity markets anticipated the earnings of five of them – Alphabet, Microsoft, Meta, Amazon, and Apple. Google parent Alphabet’s third-quarter earnings beat on both top and bottom lines. Revenue grew 15% year over year, with YouTube advertising revenue, Google Cloud revenue and Traffic acquisition costs all beating expectations.8 Microsoft shares slid after the tech giant’s revenue guidance disappointed investors, overshadowing its quarterly earnings beat. Meta fell after the Facebook parent missed the Street’s expectations for user growth and warned that capital expenditures will significantly rise in 2025.9

Shares of Amazon surged 7% on Friday, nearing an all-time high, after the technology titan reported better-than-expected third-quarter earnings. Apple fell 1.5% on Friday, despite the iPhone maker reporting a fiscal fourth-quarter earnings and revenue beat. However, net income slumped after Apple paid a one-time charge relating to a tax decision in Europe.

Along with the election, Wall Street is bracing for the next rate decision from the Fed. Traders are pricing in a 99.6% chance of a 25bps rate cut, according to CME Group’s FedWatch tool. It would follow a supersized 50bps move in September.11

Sources

- https://www.cnbc.com/quotes/VIX

- Morningstar Direct

- https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value=2024

- https://www.cnbc.com/2024/10/29/consumer-confidence-surges-as-election-nears-job-openings-move-lower.html

- https://www.cnbc.com/2024/10/30/us-gdp-q3-2024.html

- https://www.cnbc.com/2024/10/30/stock-market-today-live-updates.html

- https://www.cnbc.com/2024/10/31/stock-market-today-live-updates.html

- https://www.cnbc.com/2024/10/29/alphabet-to-report-q3-earnings-after-the-bell.html

- https://www.cnbc.com/2024/10/30/stock-market-today-live-updates.html

- https://www.cnbc.com/2024/10/31/stock-market-today-live-updates.html

- https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

Market Rebound Attempt Fails