Stubbornly High Inflation Weighs on Stocks and Bonds

by Sequoia Financial Group

by Sequoia Financial Group

The US Bureau of Labor Statistics released highly anticipated November inflation data, showing that the decline in inflation has slowed. The headline Consumer Price Index (CPI) rose 2.7% year-over-year, while core CPI (excluding food and energy prices) rose 3.3%. Automobile insurance (+12.7%) and medical care costs (3.1%) saw notable increases1. Auto insurance companies have had to pass on higher costs to policyholders, as the industry has seen three straight years of underwriting losses. Overall, costs to drivers were softened by an 8.1% decline in gasoline prices. In medical care, home healthcare costs increased by 10%, health insurance costs increased by 6%, and nursing home care increased by nearly 5%2. While overall grocery prices increased slower than headline CPI (1.6% vs. 2.7%), groceries rose significantly month-over-month by 0.5%. The cost of eggs spiked 8.2% from October 20243.

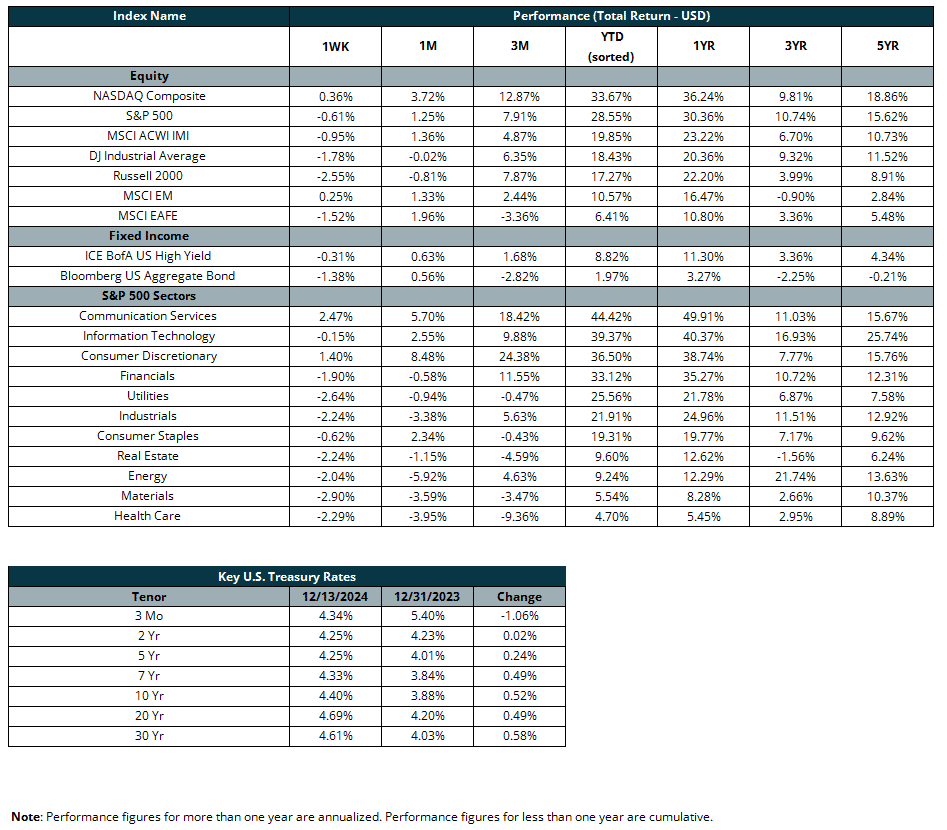

The stubborn inflation reading pushed bond yields higher and prices lower. The yield on the 10-year Treasury closed at 4.40%, up 0.25%4. The Bloomberg Aggregate Bond Index, including investment grade bonds, decreased 1.4% over the week. The Bloomberg US Corporate High Yield index declined 0.2%5, as modest credit spread tightening partially offset an increase in base Treasury rates6.

Despite the sticky inflation reading, the labor market showed enough cracks that the bond market is pricing in a near 100% probability of a 25 basis point decrease in the Fed Funds Rate7. Unemployment of 4.2% represents a 0.1% month-over-month increase8. The Federal Open Market Committee starts its monthly meeting on Wednesday, 12/18.

US stock markets ended the week lower. The S&P 500 and Dow Jones Industrial Average closed -0.6% and -1.8%, respectively. Strength in Magnificent 7 (Mag 7) names partially offset broader weakness across the market. Tesla (TLSA) and Google (GOOGL) were notable Mag 7 drivers. TSLA closed the week up 12.1% and achieved an all-time price record of $436.23/share. The company announced its highest weekly unit sales in mainland China during the fourth quarter. TSLA is up 75.6% year-to-date. Most of those gains (+73.5%) have come since the recent Presidential election5. TSLA now trades at nearly 127x earnings expected over the next 12 months. The next highest valuation among Mag 7 names is 36.6x for Amazon (AMZN) 9.

GOOGL was up 8.8% over the past week5. The company released its Willow quantum computing chip. Google announced that Willow achieved two significant milestones: (1) reduced [computing] errors exponentially when scaling up using more qubits and (2) performed a standard benchmark calculation in under 5 minutes. The fastest supercomputers would take a time that exceeds the universe’s age to compute such a calculation10.

Investors are monitoring consumer spending going into the holiday season. Strong spending in 2024 has supported corporate earnings growth, which is expected to grow 15% over the near term7. Earnings will need to continue to grow to support historically high equity valuations.

1 https://www.bls.gov/news.release/cpi.nr0.htm

5 Source: Morningstar Direct

6 https://fred.stlouisfed.org/series/BAMLH0A0HYM2EY

7 Source: Bloomberg

8 https://www.bls.gov/news.release/pdf/empsit.pdf

9 Source: FactSet

10 https://blog.google/technology/research/google-willow-quantum-chip/

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

Fed Chair Powell’s Tariff Talk Spooks Already-Nervous Markets