Budgeting is a valuable tool at any stage of life, regardless of where you fall on the wealth continuum.

Simply put, a budget is a spending plan based on income and expenses. It’s the process of tracking, planning, and controlling the inflow and outflow of income by analyzing your current situation, establishing goals, and writing a plan so you can measure your progress.

Budgeting can be daunting; the data collection, the organizing, the analysis, and plan creation. The good news is that no matter your personal of family wealth, the basics of budgeting remain the same. Here are some budgeting best practices.

Establishing a Budget

Examine Your Financial Goals

Before you establish a budget, it’s important to consider financial goals. Divide your budget goals into three categories: short-term goals (less than a year), medium-term goals (one to five years), and long-term goals (more than five years).

- Short-term goals are your immediate needs and wants, such as buying a dishwasher next month or a new car next year. Since these goals are, by definition, less than a year from being realized, they are relatively easy to estimate and plan.

- Medium-term goals are those you and your family want to achieve in the next five years, such as taking a vacation or renovating your home. Typically, these goals require more planning and careful estimation of their costs.

- Long-term goals extend well into the future, such as planning for your retirement or your child’s education. These goals require the most planning, including estimating the cost, forecasting your income, and estimating the growth of your investments. Independent research or the assistance of a financial professional may be beneficial in helping to plan for these goals.

Next, ask yourself: How important is it for me to achieve each goal? How much will I need to save? Armed with a clear picture of your goals, you can work toward establishing a budget that can help you reach them.

Identify Your Current Monthly Income and Expenses

You’ll need to identify your current monthly income and expenses to develop a budget that’s appropriate for your lifestyle. You can jot down the information with a pen and paper or use one of the many software programs designed specifically for this purpose.

Start by adding up all of your income. In addition to your regular salary and wages, be sure to include other types of

income, such as dividends, interest, and child support. Next, add up all of your expenses. To see where you have a

choice in your spending, it helps to divide them into two categories: fixed expenses (ex., housing, food, clothing, transportation) and discretionary expenses (ex., entertainment, vacations, hobbies).

You must also identify any out-of-pattern expenses, such as holiday gifts, car maintenance, and home repairs. It may be beneficial to look through canceled checks, credit card bills, and other receipts from the past year to help confirm that all expenses are accounted for.

Finally, as you list your expenses, it is essential to remember your financial goals. Whenever possible, treat your

goals as expenses and contribute toward them regularly.

Evaluate Your Budget

Once you have added up all of your income and expenses, compare the two totals. You should spend less than you earn to work toward your financial goals If this is the case, you should look at how well you use your extra income. If you find yourself spending more than you earn, you can make adjustments by looking at your expenses closely and

cutting down on discretionary spending.

Monitor Your Budget

You should monitor your budget periodically and make any necessary changes. Remember that you do not have to keep track of every penny you spend. The less record-keeping you have to do, the easier it will

be to stick to your budget. Above all, be flexible. Any budget that is too rigid is likely to fail. Be prepared for the

unexpected (e.g., a leaky roof or a failed car transmission).

Budgeting Comparisons

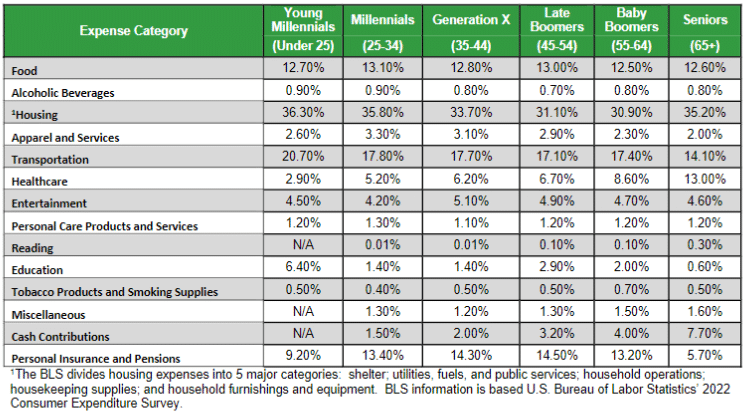

Budgeting needs may change over time. For example, healthcare expenses typically increase as we age. Education expenses are often highest early on, with another increase when your children attend college if you are helping to fund those costs. Based on information from the Bureau of Labor Statistics (BLS), the following table outlines average monthly spending by category across various age brackets.

Reasonability Test

When forecasting what the future might bring, whether in terms of income or expenses, it is prudent to ask what is

reasonable to expect. The question is simple, but the answer, often, is not.

The reasonableness test is most difficult to apply in areas where you have little experience, and the outcome might vary significantly. This is where doing some research will narrow your focus to what is genuinely reasonable, thereby minimizing guesswork. Everyone’s circumstances are unique; what is reasonable for someone else might not be reasonable for you.

Frequently, underlying factors influence what is reasonable for each individual. For example, someone with a chronic medical condition may estimate much higher healthcare expenses than someone who is consistently healthy. Similarly, a family of six would estimate much higher household and childcare expenses than a couple with one child.

Tips to Help Stay on Track

- Involve the entire family: Agree on a budget up front and meet regularly to check your progress

- Stay disciplined: Try to make budgeting a part of your daily routine

- Start your new budget at a time when it will be easy to follow and stick with the plan (ex., the beginning of the year, as opposed to right before the holidays)

- Find a budgeting system that fits your needs (ex., budgeting software)

- Distinguish between expenses that are “wants” (ex., designer shoes) and expenses that are “needs” (ex., groceries) Build rewards into your budget (ex., eating out every other week)

- Avoid using credit cards to pay for everyday expenses. Although it may seem like you are spending less, your credit card debt will continue to increase.

Conclusion

Budgeting can help you succeed financially by providing a roadmap for managing your income and expenses. It’s an effective strategy to limit overspending, identify financial patterns, prepare for emergencies, and reach short—and long-term financial goals. Budgeting can also help high-net-worth and ultra-high-net-worth individuals and families optimize investments, avoid risk, minimize taxes, and evaluate new opportunities.

Creating and sticking to a budget can be daunting. Don’t do it alone. Contact Sequoia Financial Group for insight into creating a manageable, reasonable budget that will set you up for success.

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

This material is for informational purposes only and is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy, or investment product. Diversification cannot assure profit or guarantee against loss. There is no guarantee that any investment will achieve its objectives, generate positive returns, or avoid losses. Sequoia Financial Advisors, LLC makes no representations or warranties with respect to the accuracy, reliability, or utility of information obtained from third parties. Certain assumptions may have been made by these sources in compiling such information, and changes to assumptions may have material impact on the information presented in these materials. Sequoia Financial Advisors, LLC does not provide tax or legal advice. Information about Sequoia can be found within Part 2A of the firm’s Form ADV, which is available at https://adviserinfo.sec.gov/firm/summary/117756

Markets Soar After 90-Day Tariff Pause