Buying a Home: How to Prepare and What to Expect

by Sequoia Financial Group

by Sequoia Financial Group

Buying a home is undoubtedly one of life’s most significant financial decisions. It is also exciting: having a place to call your own, building equity, and finally playing music at a band-approved (if not necessarily apartment-level) volume. But buying a home can be stressful, especially if you’re a first-time buyer. Fortunately, knowing what to expect can help.

With that in mind, we’ve compiled the list below of what you should think about and what to expect when buying a home.

What Can You Afford?

A general rule of thumb says you can afford a house that costs twice your annual salary, but it’s not that simple. Since most people finance their home purchases, buying a house usually means getting a mortgage. So, the amount you can afford to spend on a house is often tied to figuring out how large a mortgage you can afford. To figure this out, you’ll need to consider your gross monthly income, housing expenses, and any long-term debt. (If you Google “Can I afford a house?” you’ll see a monthly and purchase budget calculator. Many real estate and personal finance websites can also help you with the calculations.)

Should You Use a Real Estate Agent or Broker?

A knowledgeable real estate agent or buyer’s broker can guide you through buying a home, making the process

much easier. This assistance can be beneficial to a first-time home buyer. In particular, an agent or broker can:

- Help you determine your housing needs.

- Show you properties and neighborhoods in your price range.

- Suggest sources and techniques for financing.

- Prepare and present an offer to purchase

- Act as an intermediary in negotiations.

- Recommend professionals whose services you may need (e.g., lawyers, mortgage brokers, title professionals, inspectors)

- Provide insight into neighborhoods and market activity.

- Disclose positive and negative aspects of properties you’re considering

If you enlist the services of an agent or broker, find out how they are being compensated (i.e., flat fee or commission based on a percentage of the sale price). Many states require the agent or broker to disclose this information to you upfront and in writing.

Choosing the Right Home

Determining what you want in your home is essential in house-hunting. Knowing what you want ahead of time will make the search for your dream home much more accessible. Here are some things you may want to consider:

- Price of the home and its potential for appreciation

- Location or neighborhood

- Quality of construction, age, and condition of the property

- Style of the home

- Lot size

- Number of bedrooms and bathrooms

- Quality of local schools

- Property taxes

- Proximity to shopping, schools, and work

Applying for a Mortgage

Mortgage Prequalification vs. Preapproval

Once you know how much of a mortgage you can afford, you’ll want to shop around and compare the mortgage rates and terms various lenders offer. When you find the right lender, determine how to prequalify or get preapproval for a loan.

Prequalifying gives you the lender’s estimate of how much you can borrow and can, in many cases, be done over the phone, usually at no cost. Prequalification does not guarantee that the lender will grant you a loan, but it can give you a rough idea of where you stand.

If you’re serious about buying, however, you’ll probably want to get preapproved for a loan. Preapproval is when the lender,

after verifying your income and performing a credit check, lets you know exactly how much you can borrow. This involves completing an application, revealing your financial information, and paying a fee.

Generally, if you’re applying for a conventional mortgage, your monthly housing expenses (mortgage principal and interest, real estate taxes, and homeowners insurance) should not exceed 28% of your gross monthly income. In addition, most mortgages require borrowers to have a debt-to-income ratio of less than or equal to 43%. That means you should spend at most 43% of your gross monthly income on longer-term debt payments.

It’s important to note that the mortgage you qualify for or are approved for is not always what you can afford. Before signing

any loan paperwork, take an honest look at your lifestyle, standard of living, and spending habits to ensure that your mortgage payment will be within your means.

Before the Mortgage Application

Before you apply for a mortgage, think about the type of home you want, what your budget will allow, and the type of mortgage you might want to apply for.

Obtain a copy of your credit report and check it for accuracy; you’ll want to dispute any erroneous information and quickly correct it. Be prepared to answer any questions a lender might have of you, and be open and straightforward about your circumstances.

What You Need When Applying for a Mortgage Loan

When you apply for a mortgage, the lender will want a lot of information about you (and, at some point, about the house you’ll buy) to determine your loan eligibility. Here’s what you’ll need to provide:

- The name and address of your bank, your account numbers, and statements for the past three months

- Investment statements for the past three months

- Pay stubs, W-2 withholding forms, or other proof of employment and income

- Balance sheets and tax returns, if you’re self-employed

- Information on consumer debt (account numbers and amounts due)

- Divorce settlement papers, if applicable

You’ll sign authorizations that allow the lender to verify your income and bank accounts and obtain a copy of your credit report. If you’ve already made an offer on a house or condo, you’ll need to give the lender a purchase contract and a receipt for any good-faith deposit you might have given the seller.

Finalizing the Mortgage Application

As your mortgage application is processed and finalized, your lender is legally required to give you a Loan Estimate within three business days of receiving it. The Loan Estimate is a form that spells out important information about the loan you applied for, such as the estimated interest rate, monthly payments, and total closing costs.

The Down Payment

In the past, lenders traditionally required a down payment of at least 20% of the purchase price of a home. Today, many lenders offer loans with lower down payments. In addition, certain private and government entities have low down payment programs.

Can You Get a Low Down Payment Mortgage

Whether you can obtain a low down payment mortgage will depend on a variety of factors, such as your credit history and the type of mortgage you’re applying for.

FHA Mortgages

You may be able to get a Federal Housing Administration (FHA) mortgage with a down payment of as little as 3.5%. Qualification standards for FHA mortgages are sometimes less stringent than traditional mortgage loans, and the terms of these mortgages are generally attractive, making them ideal for first-time homebuyers. However, remember that FHA loans will require you to pay a mortgage insurance premium.

VA Mortgages

Department of Veterans Affairs (VA) mortgages are another low-down-payment option. VA mortgages are available to qualified veterans and their surviving spouses. VA mortgage terms are also generally very attractive; in many cases, little or no down payment is required.

Conventional Mortgages

With the help of private mortgage insurance (PMI), you may be able to obtain a conventional mortgage with a down payment of less than 20%. Low down payment mortgages are somewhat risky for lenders because they believe you are more likely to default on a loan in which you have very little invested. For this reason, lenders generally require PMI if you are borrowing more than 80% of the value of the home you are purchasing (i.e., your down payment is less than 20%). In addition to requiring PMI, lenders sometimes have stricter qualification standards and offer lower loan limits and higher interest rates if your down payment is less than

20%.

If you are concerned about taking on PMI payments, keep in mind that you may not have to pay PMI forever. You have the right to request that your servicer cancel PMI when you have reached the date when the principal balance of your mortgage is scheduled to fall to 80% of the original value of your home. In addition, your lender is obligated to cancel your PMI when the principal balance on your loan is scheduled to reach 78% of the original value of your home or once you have reached the midpoint of your loan’s amortization schedule, provided you have a good payment history.

What About Larger Down Payments

If you have more than 20% to put down on your future home, you may still want to take the time to weigh your down payment options. With a larger down payment, you will reduce the amount of your mortgage and, thus, the amount of interest you will pay. And since a larger down payment usually means less risk, lenders often offer lower interest rates and are more lenient toward borrowers who provide larger down payments. Also, a larger down payment gives you instant equity in your home, which can be accessed through a home equity loan or home equity line of credit. Keep in mind, however, that there may be situations where you might not want to make a large down payment. For example, you may want to keep the money in your emergency cash reserve or use it toward other investment opportunities.

Investing money for a Down Payment

If you’re saving for a down payment, you may wonder where to invest your money. The answer depends on how soon you’ll need the money. The more time you have, the more risk you may be willing to accept when considering investments. If you’re going to need the down payment within the next few years, you’ll want to minimize risk. For many, this means a bank savings account. However, you’ll also want to consider money market deposit accounts as well. Money market deposit accounts are relatively low-risk and generally pay slightly higher interest rates than bank savings accounts.

Popular Types of Mortgages

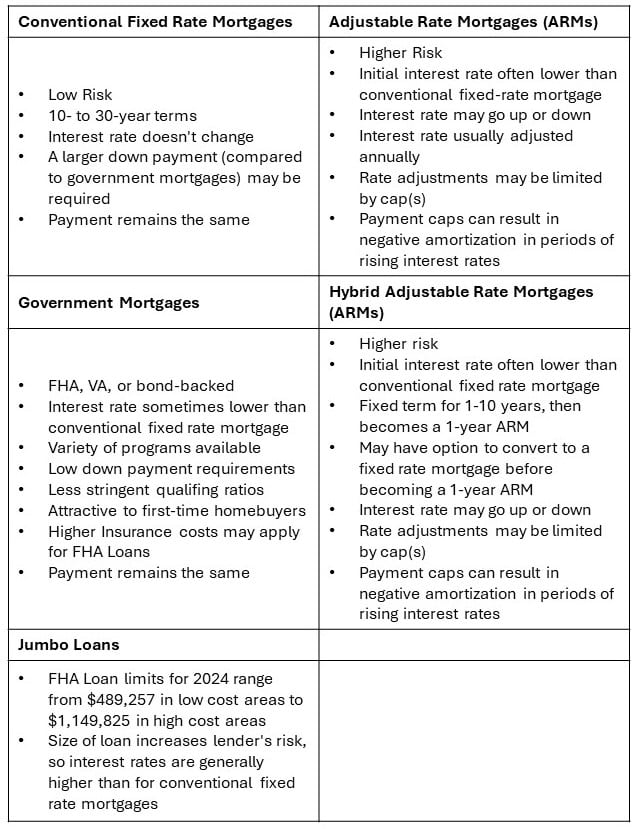

The type of mortgage that’s right for you depends on many factors, such as your tolerance for risk and how long you expect to stay in your home. Here are some characteristics of various popular types of mortgages:

Making an Offer

Once you find a house, you’ll want to make an offer. Most home sale offers and counteroffers are made through an intermediary, such as a real estate agent. To avoid future problems, all terms and conditions of the offer, no matter how minor, should be put in writing.

Typically, your attorney or real estate agent will prepare an offer to purchase for you to sign. You’ll also include a good faith or earnest money deposit. If the seller accepts the offer to purchase, he or she will sign the contract, which will become a binding agreement between you and the seller. For this reason, it’s a good idea to have your attorney review any offer to purchase before you sign.

Other Details

Once the seller has accepted your offer, you, your real estate agent, or the mortgage lender will get busy completing the procedures and documents necessary to finalize the purchase. These include finalizing the mortgage loan, appraising the house, surveying the property, and getting homeowners insurance. Typically, you would have made your offer contingent upon the satisfactory completion of a home inspection, so now’s the time to get this done.

The Closing

The closing meeting, also known as a title closing or settlement, can be a tedious process – but when it’s over, the house is finally yours!

The closing may require some or all of the following entities to be present: the seller and/or the seller’s attorney, your attorney, the closing agent (a real estate attorney or the representative of a title company or mortgage lender), and both your real estate agent and the seller’s. Depending on your state, all parties may be required to attend the closing at once, or the closing can take place over several weeks. Some closings can be conducted by mail or via the Internet.

During the closing process, you’ll receive and/or sign a variety of paperwork, including:

- Closing Disclosure: This lists the final terms of the loan you’ve selected. Your lender must send you the Closing Disclosure at least three business days before the closing meeting.

- Promissory note: This spells out your mortgage loan’s amount and repayment terms.

- Mortgage: This gives the lender a lien against the property.

- Deed: This transfers legal ownership of the property to you.

In addition, you’ll need to provide proof that you have insured the property. You’ll also be required to pay certain costs and fees to obtain the mortgage and close the real estate transaction.

Conclusion

As you can tell, the home-buying process has many moving parts, and knowing what you’re getting into at the start will help make it smoother. If you have questions or concerns about your finances and buying a home, contact Sequoia Financial Group. We’ll help you get your financial house in order so you can buy your actual house.

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

Fed Chair Powell’s Tariff Talk Spooks Already-Nervous Markets