Colossal IT Outage Makes a Bad Week Worse for Big Tech

by Sequoia Financial Group

by Sequoia Financial Group

Bank of America and Goldman Sachs kicked off last week with strong earnings reports. Goldman’s revenue climbed 17% year over year, while its net earnings easily beat expectations.[1] Meanwhile, Bank of America guided for higher net interest income and a stronger second half.[2] Later in the week, regional banks kept the momentum going for financials, with U.S. Bancorp[3] and Huntington Bancshares[4] both delivering strong results. For the week, the S&P Banking Index jumped 6%.[5]

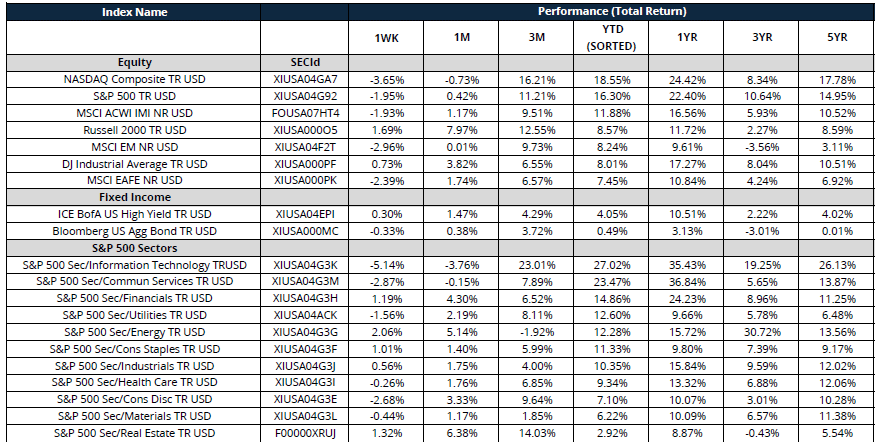

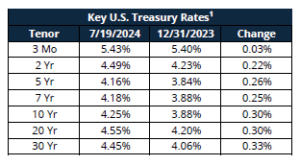

Robust earnings from financials and greater confidence that the Federal Reserve will cut rates in September prompted a rotation out of technology names into more rate-sensitive sectors. In fact, the tech-heavy NASDAQ suffered its worst day since 2022 on Wednesday, dropping 2.8%, while the less-tech-exposed Dow Jones Industrial Index added 0.60%.[6] The performance shift was even more dramatic for small-cap stocks, which jumped 3% on Wednesday, on the hopes that lower interest rates would help lessen the burden of their higher debt levels.

Thursday brought more selling but it was more broadly based, with the three major stock indices all closing lower. The news wasn’t all negative, though. Taiwan Semiconductor reported strong second quarter earnings as demand for its advanced chips remained robust. And Goldman Sachs analysts expect Apple to report double-digit growth in both iPad and Mac sales and beat consensus earnings expectations for the quarter when the company reports on August 1.[7]

The sell-off continued Friday, driven in part by what is being described as the worst IT outage in history.[8] Airports, banks, hospitals, and users were stung by a massive outage as cyber-security provider Crowdstrike pushed a flawed tech update to clients. Crowdstrike stock dropped more than 10% on the news, as flights were cancelled, surgeries rescheduled, and certain 911 services disrupted. Overall, the S&P 500 and NASDAQ suffered their worst week since April. The S&P 500 dropped 2%, while the NASDAQ slid 3.7%. Meanwhile, the Dow and the small-cap Russell 2000 ended the week higher.[9]

Looking ahead, earnings season rolls on, with Alphabet, Coca Cola, Tesla, IBM, and more reporting this week. We’ll also get new readings on employment, inflation, and consumer sentiment.

Sources:

- https://www.cnbc.com/2024/07/15/goldman-sachs-gs-earnings-2q-2024.html

- https://www.nasdaq.com/articles/bank-america-says-its-poised-start-growing-its-net-interest-income-again-it-time-buy-stock?time=1721391300

- https://finance.yahoo.com/news/u-bancorp-usb-q2-earnings-115503708.html

- https://finance.yahoo.com/news/huntington-boosts-earnings-buoyed-strong-130443094.html

- https://www.spglobal.com/spdji/en/indices/equity/sp-banks-select-industry-index/#overview

- https://www.cnbc.com/2024/07/16/stock-market-today-live-updates.html

- https://www.cnbc.com/2024/07/17/stock-market-today-live-updates.html

- https://www.cnbc.com/2024/07/19/latest-live-updates-on-a-major-it-outage-spreading-worldwide.html

- https://www.cnbc.com/2024/07/18/stock-market-today-live-updates.html

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

Stocks Sink as Tariff Fears and Weak Economic Data Shake Investor Confidence