Equities Advance on Data Bolstering Soft-Landing Narrative

by Sequoia Financial Group

by Sequoia Financial Group

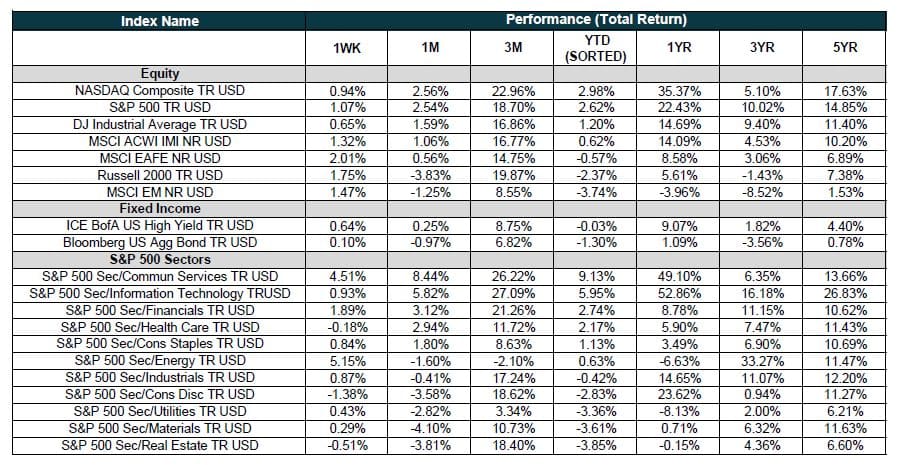

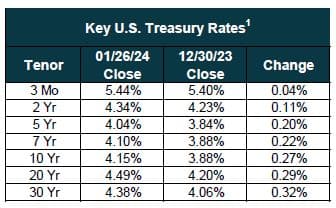

Equity markets ended higher last week after a slew of strong economic data releases. The Russell 2000 was up 1.75% and led the markets. The S&P 500 and NASDAQ Composite rose 1.07% and 0.94% respectively. US Treasury yields had a quiet week, but the entire curve still remains above 4%. Elsewhere, oil prices were higher on cold weather disruptions, optimistic demand, and continued Middle East tensions. Additionally, Chinese equities tried to bounce after authorities announced measures to cut the reserve requirement by 50 bps and release $139.8B in long-term capital to help support the stock markets.1

The week started quietly on Monday. The S&P 500 crept towards new highs and marked its first new record high in over 500 trading days, the sixth-longest streak in history. Small caps led the session with the Russell 2000 jumping more than 2%. While 2024 has been led by the Magnificent Seven and Big Tech, market gains are starting to broaden to other sectors.

With no real directional drivers, markets continued their upward trend on Tuesday. The NASDAQ and S&P 500 closed near session highs. Corporate earnings have generally been strong and in line with estimates, but reactions have varied wildly. Verizon Communications (VZ) gapped up after reporting subscriber additions above expectations.2 Homebuilders fell broadly after D.R. Horton (DHI) reported its first earnings gain in five quarters but missed estimates.3 The company noted that material costs have fallen, but the labor market remains tight and expensive.3

Though the major indices notched their fifth straight day of gains on Wednesday, equity markets ended the day near their lows. January flash Manufacturing PMI came in at 50.3, beating consensus of 47.9 and returned to expansionary territory on improved order inflows.4 January flash Services PMI was 52.9, beating estimates of 51.4 as output growth was driven by more robust demand conditions.4

Equity markets finished higher on Thursday near session highs. Markets gapped up at the open after reports that Q4 GDP grew 3.3%, beating estimates of 2%.5 The US economy grew 2.5% in 2023 powered by strong consumer and government spending.5 Initial jobless claims increased to 214K, above estimates of 200K.6 Recent macro data largely supports the soft-landing narrative, showing continued growth driven by a resilient consumer with diminishing inflation pressures.

On Friday, equity markets ended the quiet session mixed. The S&P 500 and NASDAQ broke their six-day streak of gains but were still higher for the week. December core PCE came in at 0.2% month on month, in line with expectations. Annualized core PCE was 2.9%, the lowest level since March 2021. Despite the strong macro data, probabilities of a March rate cut remain roughly 50-50.

Sources

- https://www.cnbc.com/2024/01/25/china-is-ramping-up-stimulus-to-boost-market-confidence-is-it-enough.html

- https://www.verizon.com/about/news/verizon-finishes-2023-strong-cash-flow-and-wireless-customer-growth

- https://investor.drhorton.com/~/media/Files/D/D-R-Horton-IR/press-release/q1-fy-2024-earnings-release.pdf

- https://www.pmi.spglobal.com/Public/Home/PressRelease/e378d753625f446d9d4ef29b3f71a1c4

- https://www.cnbc.com/2024/01/25/gdp-q4-2023-the-us-economy-grew-at-a-3point3percent-pace-in-the-fourth-quarter.html

- https://www.dol.gov/ui/data.pdf

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

Stocks Extend Rally on Trade and Earnings Positives