Fed Moves Aggressively in Long-Awaited Policy Shift

by Sequoia Financial Group

by Sequoia Financial Group

Equity markets ended the week higher following the decisive move by the Federal Reserve to cut the fed funds rate. It is the first rate cut by the Fed since the early days of the COVID pandemic and since it began hiking in March 2022, and marks a shift in its monetary policy approach.

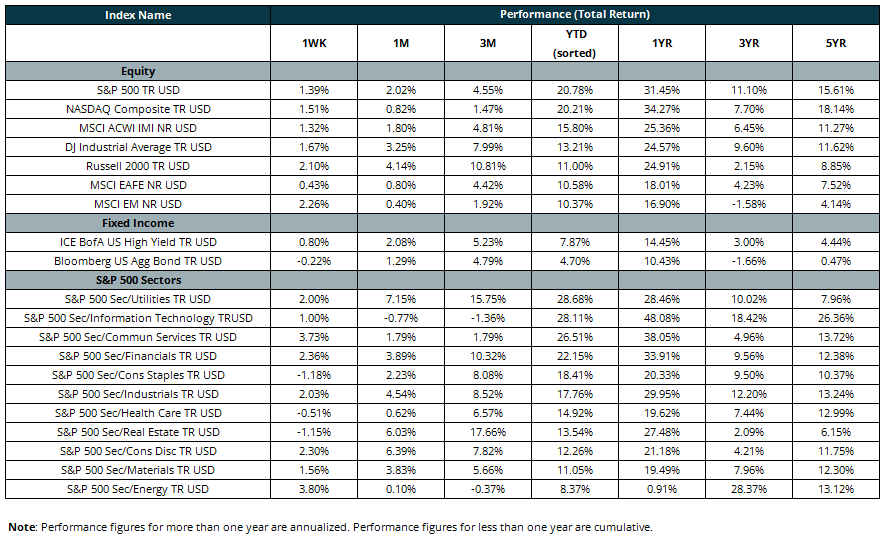

For the week, the Dow Jones Industrial Average and the S&P 500 Index posted new highs, reaching these levels on Thursday as markets rallied post the Fed announcement. The technology-heavy NASDAQ Composite Index advanced 1.51% while the S&P 500 posted an increase of 1.39%. Meanwhile, the Dow outperformed its counterparts, rising 1.67%.1

In an encouraging sign, the Russell Midcap Index and the small-cap Russell 2000 Index rose 1.72% and 2.10%1, respectively, possibly indicating a broadening of the market, especially to those areas that have lagged.

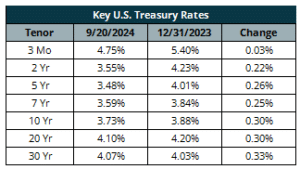

However, in the fixed income markets, the Bloomberg US Aggregate Bond Index fell -0.21% on the week.1 Yields on the front end of the US Treasury curve (two years and in) fell, while the long end of the curve rose as concerns over a slowing economy faded. The US 10-year Treasury bond rose 7 bps, closing on Friday at 3.73%.2 The closely watched spread between the 10-year Treasury bond and the 2-year Treasury note has now widened to 18 bps and is no longer inverted.3

Markets were subdued early in the week as traders and investors anxiously waited for the Fed meeting. Based upon prior comments from Fed Chair Powell, market participants were unanimous in expecting a rate cut, but were undecided whether the Fed would cut 25 or 50 bps.

On Wednesday, in a bold move that surprised a segment of the market, the Fed delivered a 50-basis-point interest rate cut, bringing the federal funds rate to 4.75%-5%. The size of the cut was in line with market expectations, which had shifted in recent days. “The Committee has gained greater confidence that inflation is moving sustainably toward 2%, and judges that the risks to achieving its employment and inflation goals are roughly in balance,” the Fed’s post-meeting statement said.4

One of the market’s concerns was that the Fed was behind the curve in not having reduced rates earlier. In response, Powell remarked, “We don’t think we’re behind; we think this is timely. But I think you can take this as a sign of our commitment not to get behind.”5

The rationale for the larger cut, and the key theme of the meeting, was the shift in focus from inflation risks to employment risks considering the recent softening in the labor market data. The Fed Chairman highlighted in particular the July and August employment reports and the revisions to payrolls based on the Quarterly Census of Employment and Wages, and said that the FOMC might have cut at its July meeting if it had seen the July employment report by then.6

Also at the Fed meeting, the members of the Committee updated their Summary of Economic Projections (SEP), which reflects the collective views of the voting members as to their expectations of GDP, PCE inflation, unemployment and the fed funds rate. By year-end, the members expect GDP to be 2% (down from 2.1% in the June SEP), unemployment to rise to 4.4% (up from 4%), PCE inflation to decline to 2.3% (down from 2.6%) and for the fed funds rate to approximate 4.4% (down from 5.1%).7

Despite some choppiness immediately following the initial announcement, stocks rallied. On Thursday, the Dow advanced 603 points, topping 42,000 for the first time. The S&P 500 rose 2%, marking its first break above 5,700, while the NASDAQ surged 3%.

Economic data released on Thursday showed traders got some validation that the Fed was engineering a soft landing for the economy: weekly jobless claims fell by 12,000 to 219,000, which was far below estimates.8

As we look forward to the next Fed meeting on November 4, the expectations are for further interest rate cuts. However, market participants are split 50/50 between a 25 bps or 50 bps reduction.9

Sources:

- Morningstar Direct

- https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value=2024

- https://fred.stlouisfed.org/series/T10Y2Y

- https://www.cnbc.com/2024/09/18/fed-cuts-rates-september-2024-.html

- https://finance.yahoo.com/video/powell-says-fed-not-behind-195005596.html

- Goldman Sachs Economics Research: US Daily: September FOMC Recap: Rate Cuts Begin with a 50.

- Summary of Economy Projections:

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20240918.pdf

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

Fed Chair Powell’s Tariff Talk Spooks Already-Nervous Markets