Guardianship: 10 FAQs We Can Answer For You

by Sequoia Financial Group

by Sequoia Financial Group

There’s perhaps no greater love than that of a family. Through thick and thin, the bonded family unit can confront anything, good, bad, or otherwise. And while there’s no greater joy than celebrating happiness within a family, the family’s heartache can be just as intense, mainly when there’s a need for challenging conversations and hard decisions.

If you have a family member with an IDD or members of your family whose judgment and decision-making abilities are in decline, it might be time to consider guardianship. But what is guardianship? When is guardianship appropriate? What are the financial responsibilities of a guardian? And how is guardianship implemented?

Below, we’ve compiled the ten most frequently asked questions and answers about guardianship for you to use as a guide to determining whether guardianship is best for your loved one.

1) What is Guardianship?

Guardianship, or conservatorship, is a legal process utilized when a person can no longer make or communicate safe or sound decisions about their person and/or property or has become susceptible to fraud or undue influence. Because establishing guardianship may remove considerable rights from an individual, it should only be considered after alternatives to guardianship have proven ineffective or are unavailable.[1]

When the court appoints a guardian for the person, the guardian may have the following responsibilities:

-

- Determine and monitor residence as well as day time activities.

- Consent to and monitor medical treatment.

- Consent and monitor non-medical services such as education and counseling.

- Consent and release of confidential information.

- Act as representative payee.

- Maximize independence in the least restrictive manner.

- Report to the court about the guardianship status at least annually.

2) What are the types of Guardianship?

Types of guardianship may vary from state to state. It is essential to consult your special needs planning attorney and financial advisor and search your state’s guardianship association or advocacy organization for information specific to where your loved one lives. Some of the most commonly used forms of guardianship are listed below.

-

- Guardian of the person is a type of guardianship where the guardian manages the personal affairs of the child, older adult, or incapacitated individual, such as medical needs, nutrition, rent, and transportation. [2]

- A guardian of the estate or conservatorship should be considered for persons with disabilities who cannot manage their finances and have income from sources other than benefits checks, assets, and property. The conservator is responsible for handling the protected person’s financial resources but is not personally financially responsible for the protected person’s own resources. In most jurisdictions, the conservator must file an annual accounting of the protected person’s funds with the court.[3]

- A limited guardianship allows the court to appoint someone as guardian over only the portion of a person’s life where they are both incompetent and have a need. Thus, there can be a limited guardian for medical purposes only (to provide consent for medical procedures), placement purposes only (relocation to a new home), or for the limited purpose of approving behavior plans and psychotropic medications.[4] The benefit of limited guardianships is that the guardian’s responsibilities can be tailored to fit the person’s special needs in the least restrictive manner. Further, the person has not been declared incompetent under limited guardianship.[5]

- A temporary guardian or conservator may be appointed by the court in an emergency when certain decisions must be made immediately. In many states, permanent guardianship or conservatorship must be requested along with a temporary appointment. The duration of a temporary appointment is dictated by state law, generally up to 90 days. There may also be an option to name one person as a temporary guardian and have another person(s) serve as the permanent guardian.[6]

- A successor guardian is an adult identified by the caregiver and approved by the courts who will assume care and responsibility for the person if the caregiver can no longer care for the child.[7]

- In some situations we suggest co-guardianship so the succession plan is built in and a new court process does not need to be completed.

3) When are guardianship or conservatorship appropriate?

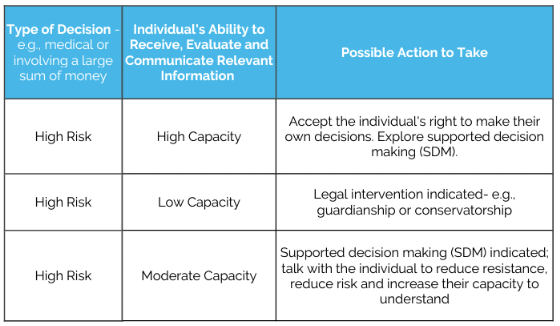

In the case of a person with special needs, their capacity to receive, evaluate, and communicate information about a decision, along with the importance of the decision, should influence whether the protected person requires guardianship or conservatorship.

The chart below generalizes the issues involved in guardianship vs. self-determination but may be viewed as a guideline to help parents decide when to consider intervention. “High Risk” decisions, such as receiving needed medical care or spending or transferring a large sum of money, can be the first place to focus. [8]

4) Are there alternatives to guardianship?

Guardianship should be a last resort because it removes individuals’ legal rights and restricts their independence and self-determination. It should be used only when no suitable, less restrictive options exist.[9]

If an individual with a disability can make some but not all decisions, one or more of the alternatives to guardianship discussed here should be considered. Courts will generally favor placing individuals in the Least Restrictive Environment needed, and the following alternatives to guardianship are listed from least restrictive to most restrictive:

-

- Supported decision making (SDM) allows an individual with a disability to make choices and decisions about their life with a designated person or team of trusted supporters. They can stay in charge but have help when needed. The underlying principle of SDM is that everyone has the right to choose. A good resource is the National Resource Center for Supported Decision-Making.[10]

- Arrangements can be made with most banks for benefits checks, such as Social Security or SSI payments, to be sent directly to the bank for deposit. In addition, arrangements can be made authorizing the bank to send certain sums of money regularly to a specified party, such as the landlord or the person with a disability for spending money. This helps provide structure to allow for budgeting and money management. (Remember to keep this account balance below $2,000 if they receive SSI benefits.)

- A representative payee can be named to manage the funds of a person with a disability who receives benefits checks from Social Security, Railroad Retirement, or the Veterans Benefits Administration. Benefits checks are sent to the representative payee, who manages these funds and spends them to benefit the disabled person.

- A durable power of attorney (POA) for property is a legal document that grants one person the legal authority to handle the financial affairs of another. Generally, a POA should be used when the individual with disabilities has the capacity to make fundamental, meaningful decisions and does not require full guardianship but may not be able to make complex financial decisions without support.

- A durable POA for health care, also known as a health care proxy, is a legal document granting decision-making powers related to health care to an agent; it may generally provide for the removal of a physician, the right to have the incompetent patient discharged against medical advice, the right to medical records and the right to have the patient moved or to engage another treatment. A durable POA should be considered for individuals who are presently capable of making decisions about their health care and wish to allow someone to help make important health care decisions in the future.

- An appointment of advocate and authorization allows a person with a disability to designate an agent to advocate on their behalf with administrative agencies such as the State Department of cognitive disability, the Department of Mental Health Services, or the Department of Medical Assistance. The agent can be granted specific powers, such as access to rehabilitation and school records, as well as the authority to release records, to approve placement or services, to attend meetings, and to advocate generally on behalf of the individual with a disability. The document must be in writing, witnessed, and, depending on state law, notarized.

- A HIPAA Release form allows a person to receive protected medical information about the person. Suppose an individual would like their parent or their desired health care proxy to be able to discuss their medical information with their doctors. In that case, they should provide the authorization for their doctors and/or therapists to discuss this information with those they appoint. Having a HIPAA Release form on file with those doctors and therapists will help allow them to discuss protected medical information.

- Trusts may be an appropriate alternative to the appointment of a conservator in some circumstances. Creating a trust may be less expensive than a conservatorship in that no bond is required; it will keep the courts and their associated costs out of everyone’s life (in most cases, the permission of a court is not needed to make disbursements from the trust or to make investments). A property drafted Special Needs Trust will also protect the beneficiary’s assets without requiring that they be declared incompetent by a court. Careful consideration must be given to the type of trust used.

- A special needs trust will make it possible for the beneficiary to receive the benefit of extra income without losing valuable state and federal benefits. See “A Parent’s Guide to Setting Up a Special Needs Trust.”[11]

5) What are the key roles and responsibilities of a guardian?

A Guardian’s duties will vary depending on the adult’s abilities and limitations but generally will include the following:

-

- Provide for the adult’s social, educational, recreational, and future needs.

- Ensure the adult’s living situation is appropriate and safe (least restrictive environment).

- Provide for the adult’s everyday basic needs and safety.

- Make ordinary medical care decisions and arrange for needed treatment.

- Apply for health insurance and other benefits, if needed.

- Advocate for the adult’s legal rights and independence.[12]

Check with a disability law professional or the probate court in your state to confirm details for your case.

6) What qualities should you consider when selecting a guardian and successor guardians?

Any person over the age of 18 may be a guardian. Parents often ask the court to appoint one or both of them as guardians, but even in this case, the choice of a successor guardian remains. (Parents should remember that if they have access to a Medicaid stipend to be their child’s paid caregiver, they will not be able to be their legal guardian. In this case, parents may consider choosing one parent to be the guardian while the other serves as the Medicaid provider.) Parents should talk with potential successor guardians to ensure they fully understand this role’s responsibilities and resources.

One of the significant issues to discuss is where the adults with disabilities will live. The protected person may be living independently in residence, at home, or maybe directed to live in the home of the proposed guardian. In some instances, it may be appropriate for the stability of the person to have the guardian move into their home or have the guardian hire others to provide care.

While proximity is important, parents should think carefully about their family and friends and consider successor guardian decisions based not on which sibling is the oldest or who is living closest but on who will best attend to the care and protection of the protected person if the parent is not living. In addition to naming the successor guardian in their will, parents should prepare a Letter of Intent[13] to provide guidance on the details of daily living.

7) How long do the responsibilities of a guardian last?

Guardianship ends when the person dies. Guardianship also ends when a guardian dies, cannot perform their duties, or petitions the court that they no longer want guardianship of the individual. The court will appoint a new guardian, and the parents often identify the successor guardian but that person will be required to go through a court process, it is not an automatic appointment.

8) What are the financial responsibilities of a guardian?

In general, the guardian or conservator is responsible for handling the individual’s financial resources but is not personally financially responsible for the protected person from their own resources.

A person may have a special needs trust established for them and a trustee appointed to oversee the management of the trust’s assets. The guardian will request funds from the trustee to maintain the person’s household and pay for trips, vacations, clothing, etc., for the protected person’s benefit. It is essential to have a respectful and trusting relationship between the guardian and trustee, as the trustee may resist making some requested distributions if the guardian and trustee have a conflict or if the trustee is not comfortable with the distribution rules of a special needs trust. Before hiring a professional or corporate trustee interview them about their experience with special needs trusts and benefits planning.

9) How and when do you ask someone to be a guardian?

Planning for guardianship is a critical legal task for all parents and even more so for parents of a person with disabilities. Family, friends, and professionals should be carefully considered when determining who would be best suited to each role in helping care for the protected person.

Parents need to have an open discussion and ongoing communication with the people they wish to be involved in caring for their child in the future. (An example is the story of our Nadworny family’s planning for James’ guardianship in A Talk with My Parents Around Our Holiday Table.)

Many considerations must be weighed, and a potential guardian’s financial resources are among them. For example, a younger sister with small children may have the qualities to be an ideal successor guardian but lack the cash flow and savings that would enable her to take on the guardianship responsibilities fully. Suppose there are sufficient resources in a special needs trust. In that case, it is possible to provide for this sister’s retirement, healthcare, and other necessary expenses and enable her to take on the guardianship role.

10) How do you implement your guardianship plan?

Nominate a guardian in a will. A parent may nominate someone to be the guardian of their child (whether under 18 or, if disabled, 18 and over). This person will still have to be confirmed by the court after the parent’s death, but it is wise to include the nomination in the will so the parent’s preference is known in their will.

Designate a standby guardian. Most states have a process by which a parent can designate a guardian to take care of a child in the event the parent is incapacitated or has died. Suppose the parent believes the other parent or family members will contest their choice of guardian. In that case, the surrogate or probate court can confirm the guardianship designation before the parent dies. Not all states have this process, but if it is available where the protected person lives, the parent should nominate a guardian in their will and designate a standby guardian.

Conclusion

It’s impossible to know precisely what will be needed to provide for your family’s future needs and goals, but there are steps you can take right now to ensure their safety, comfort, and continuity of care. Compiling all the necessary paperwork and directives can feel overwhelming; if you need assistance, please contact us. Sequoia Financial has an entire team dedicated to assisting families with special needs plan for a full and flourishing future.

Sources:

- https://www.guardianship.org/what-is-guardianship/

- https://www.law.cornell.edu/

- https://www.specialneedsplanning.com/10-faqs-about-guardianship-of-adults-with-disabilities

- https://www.disabilityrightsohio.org/guardianship-frequently-asked-questions

- https://www.specialneedsplanning.com/10-faqs-about-guardianship-of-adults-with-disabilities

- https://www.specialneedsplanning.com/10-faqs-about-guardianship-of-adults-with-disabilities

- https://www.lawinsider.com/

- https://www.specialneedsplanning.com/10-faqs-about-guardianship-of-adults-with-disabilities

- https://www.justice.gov/elderjustice/guardianship-less-restrictive-options

- https://www.specialneedsplanning.com/parents-guide-to-setting-up-a-special-needs-trust

- https://supporteddecisionmaking.org/

- https://www.massguardianshipassociation.org/

- https://www.specialneedsplanning.com/parents-guide-to-the-special-needs-letter-of-intent

- https://www.specialneedsplanning.com/blog-1/a-talk-with-my-parents-around-our-holiday-table

Disclosure: This material is for informational purposes only and is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Diversification cannot assure profit or guarantee against loss. There is no guarantee that any investment will achieve its objectives, generate positive returns, or avoid losses. Sequoia Financial Advisors, LLC makes no representations or warranties with respect to the accuracy, reliability, or utility of information obtained from third-parties. These sources may have made certain assumptions in compiling such information, and changes to assumptions may have material impact on the information presented in these materials. Sequoia Financial Advisors, LLC does not provide tax or legal advice. Information about Sequoia can be found within Part 2A of the firm’s Form ADV, which is available at https://adviserinfo.sec.gov/firm/summary/117756

Markets Soar After 90-Day Tariff Pause