Summary

- The resurgence of nuclear energy may have positioned it as a solution to climate change

- As much as 18% of global electricity generation was once sourced from nuclear energy, but that percentage has declined to 10% today after decades of declining investment

- Technological advancements could reduce costs and safety concerns, allowing nuclear to become a viable source of stable energy to complement the intermittency of renewables

- Investment opportunities include Small Modular Reactor companies and uranium futures

The reliance on nuclear energy to help alleviate Europe’s recent energy crisis may turn out to be a catalyst positioning nuclear to become a long-term solution to climate change. At their peak in August 2022, electricity prices had increased 411% and 305% year-over-year in Germany and Italy, respectively. Although Germany extended the operations of its nuclear fleet, this short-term pivot provided little support. The number of nuclear power plants in Germany is down to just three, following the country’s prior decision to completely phase out nuclear energy. Nuclear provided no support to Italy, which shut down the last of its plants over 30 years ago. It may be time for countries such as Germany and Italy to reconsider.

History of Nuclear Energy

Although nuclear energy is a low-emissions energy source, a few accidents, and even disasters, precipitated nuclear’s falling out of public favor over recent decades. The partial meltdown of the Three Mile Island (TMI) nuclear facility near Harrisburg in 1979 may be the most memorable to Americans. However, this accident pales in comparison to the Chernobyl, Ukraine disaster of 1986 and the Fukushima, Japan disaster of 2011. Both accidents were responsible for significant loss of life. Public distrust of nuclear energy is also high due to the association with the atomic bomb explosions over Hiroshima and Nagasaki.

As of the late 1990s, nuclear’s share of global electricity production was around 18% but has since decreased to 10% today. The decline has been more pronounced for some countries such as Japan, which sourced 35% of its energy from nuclear in 2002, but today sources only 5% from nuclear. Despite the declining worldwide energy share, nuclear is still a leading source of low-emissions electricity, second only to hydropower. In developed countries, nuclear is the leading source of low-emissions electricity.

Nuclear’s Role in the Energy Landscape

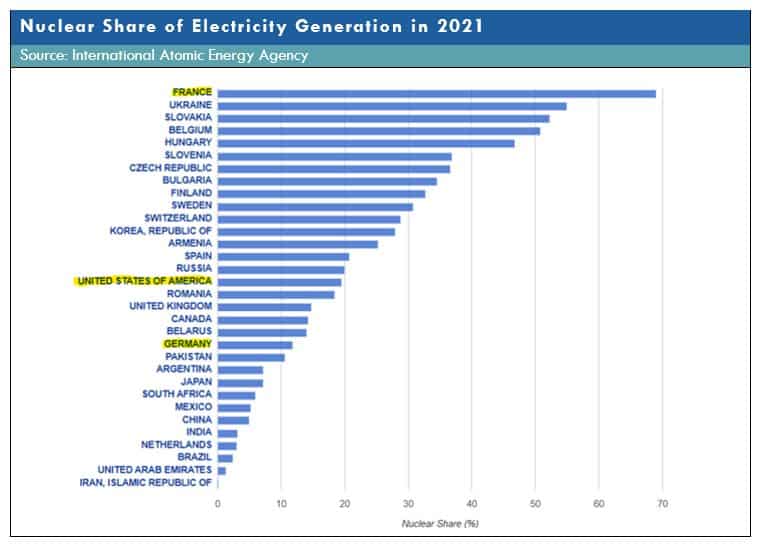

As depicted in the graphic below, nuclear energy’s share of total electricity generation varies significantly by country. France leads the world at 69%, reflecting the country’s strategic initiatives to prioritize energy security. However, maintenance issues have occurred at many of the country’s power plants over the past several years. When availability factors were at their lowest in March 2022, France’s nuclear plants could only provide electricity 54% of the time. Compare this to the US, which has achieved up to 93% availability factors. For the first time in over 40 years, France was a net importer of electricity in 2022.

Nuclear’s share of total electricity generation varies significantly by country. Notable developed countries include France at 69%, the US at 20%, and Germany at 12%.

Nuclear’s share of electricity generation in the US rose to around 20% by 1990 but has since stagnated at that level. If it weren’t for recent government initiatives to preserve the US’s aging nuclear fleet, that share would be expected to decline in the near term. The Civil Nuclear Credit Program (2022) is a $6 billion program component of the Bipartisan Infrastructure Law. Under the program, nuclear power plant owners and operators can extend plant operations, if they can evidence that plant closures would result in increased emissions.

Germany is an example of a developed country that sources little of its electricity from nuclear. Following the Fukushima accident, former Chancellor Angela Merkel decided to phase out nuclear energy. While nuclear represented 12% of total electricity generation in 2021, it only represented 6% by the end of 2022. That percentage was slated to drop to 0%, but the operations of the country’s three remaining nuclear reactors were extended into the first half of 2023.

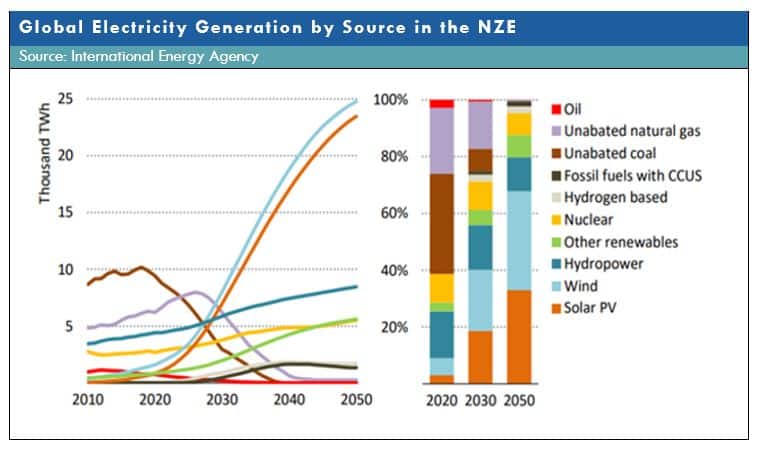

The below graphic shows how global electricity generation by source changes leading up to the International Energy Agency’s Net Zero Emissions (NZE) 2050 goal. Renewables, notably Wind and Solar Photovoltaic (PV), take away the lion’s share of generation from unabated (i.e. without the use of carbon capture) natural gas and coal by 2030. Overall nuclear energy output will increase slightly through 2050, but its share of electricity generation will decline.

Renewable energy sources, notably wind and solar PV, are expected to be the leading contributor to the Net Zero Emissions goal. Nuclear energy is expected to provide system flexibility to complement the intermittency of renewables.

Although renewable energy sources are expected to be the leading contributor to the NZE, these sources have limitations. Wind and solar are intermittent in that wind turbines only turn if there is wind, and solar cells only absorb sunlight during the day. Current technology does not allow for storing significant amounts of this intermittent energy. Therefore, renewables must be supplemented by dispatchable (on-demand) energy sources. Nuclear could provide system flexibility during times of stress or when renewables are unavailable, but nuclear has its own challenges.

Challenges and Opportunities

Besides safety concerns, high costs are the biggest roadblock to nuclear energy becoming a viable stable energy source. High costs are driven by average construction times of 6-10 years (some plants have taken up to 20 years), significant land occupancy (emergency planning zones (EPZ) must cover about 10 miles), and a minimum required staff of skilled workers. Nuclear’s cost burden must decline relative to its current costs and the costs of other stable energy sources. Fossil fuel generation with Carbon Capture Utilization and Storage (CCUS) technology appears to be nuclear’s main competitor. Although the costs of CCUS are currently not economically feasible, future cost savings could be greater than those of nuclear energy.

The design of an emerging technology, Small Modular Reactors (SMRs), may address the cost burdens of conventional nuclear technology. Instead of being built on-site, SMRs would be constructed in a factory and shipped to their destinations. This represents a significant cost savings relative to conventional nuclear reactors, which are custom-built and subject to construction delays. Other advantages of SMRs over conventional reactors include construction lead times reduced to ~3 years, EPZs reduced to ~40 acres, and recycling of spent nuclear fuel. Many countries that use conventional reactors recycle only some of their nuclear waste. Instead, waste is stored underground at plant sites. Lastly, SMRs would be small enough to be installed on decommissioned coal power plants. This would result in further cost savings by taking advantage of existing infrastructure (e.g. cooling systems) and skilled workforces.

Safety remains a concern due to the severity of a possible accident, regardless of technology improvements. But how practical are these concerns? Although the Chernobyl accident resulted in significant fatalities, one death resulted from Fukushima and no deaths resulted from TMI. Many causes of these accidents have also turned out to be preventable. At Fukushima, diesel engines serving as emergency power sources were placed on the ground floor of the plant, making them reachable by tsunami waves. While easy to judge in hindsight, plant operators would presumably plan differently in light of what has been learned from previous incidents.

Russia’s involvement in nuclear energy presents a multi-layered problem to the energy security of the rest of the world. In addition to being a major player in reactor construction, Russia controls a 38% share of the global uranium processing market. Although recent EU sanctions have not yet banned uranium imports, it is uncertain whether future sanctions will do so. While the US does not rely heavily on Russian imports of uranium, it does rely heavily on imports from Kazakhstan. As an old Soviet Union republic, Kazakhstan could certainly be subject to the same political influence currently placed on Ukraine.

Concluding Remarks

So, is nuclear power the solution to climate change? It may not be the solution (that designation is reserved for renewables, which create zero emissions and are cheaper options), but it will undoubtedly be part of the NZE solution. The potential is more significant if costs and safety concerns are further reduced by technology advancements such as SMRs.

While it may be too early to invest in this nascent technology, American companies with notable SMR projects include GE (in a joint venture with Hitachi), Kairos, NuScale, and Westinghouse. NuScale’s SMR design was recently certified by the US Nuclear Regulatory Commission. The NZE does not consider using SMRs, therefore nuclear’s long-term role may be underestimated if SMR technology catches on.

Other technological improvements may make SMRs obsolete before commercial feasibility is achieved. CCUS technology may advance such that we can still burn fossil fuels without significant emissions. Additionally, nuclear fusion has the potential to create energy without inconvenient nuclear waste. Scientists recently achieved a significant milestone by creating a nuclear fusion reaction that produced more energy than the energy required for ignition. Another potential breakthrough discovery relates to Brilliant Light Power’s (New Jersey) claim of developing a new energy source called hydrinos. If the technology turns out to be viable, it has the potential to upend many of our expectations of where we source future energy.

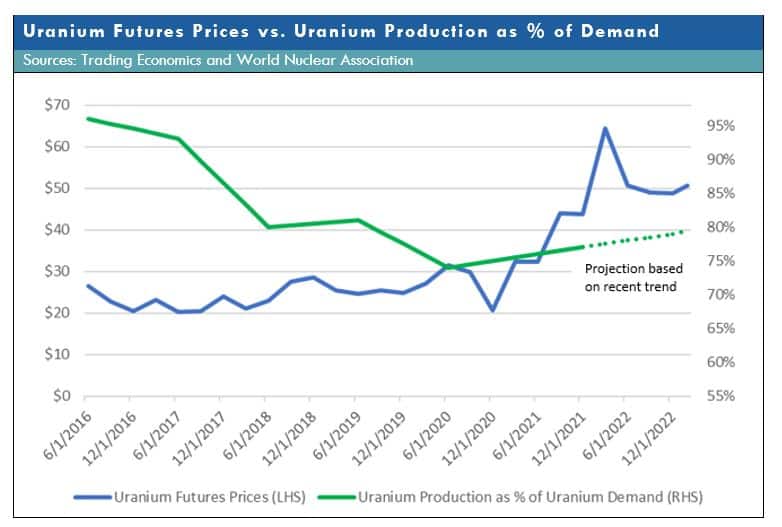

Even though obtaining long exposure to SMRs would only reap benefits in the long-term, potential gains are available to those with short-term optimism for conventional nuclear energy. The cumulative 114% increase in uranium futures prices from 2016 to 2021 coincided with a decline in uranium production as a proportion of uranium demand over the same period. This proportion declined from 96% in 2016 to 77% in 2021. If one expects production to continue to lag demand from the renewed interest in nuclear energy, uranium futures prices may have further upside. This would be especially likely if sanctions are placed on the Russian uranium processing industry.

Regardless of your interest in profiting on nuclear energy, we hope this letter was thought-provoking on nuclear’s potential revitalization. Thank you for your continued support.

References

Acton, James M. and Hibbs, Mark (2012), Why Fukushima was Preventable, https://carnegieendowment.org/files/fukushima.pdf

Civil Nuclear Credit Program, https://www.energy.gov/gdo/civil-nuclear-credit-program

Dalton, Matthew (2017), France’s EDF Lost $19 Billion After Nuclear Outages, https://www.wsj.com/articles/frances-edf-lost-19-billion-after-nuclear-outages-7c83f45c

Germany Electricity Price, https://tradingeconomics.com/germany/electricity-price

Gianarikas, George (2022), A nu moment, Canaccord Genuity LLC

Italy Electricity Price, https://tradingeconomics.com/italy/electricity-price

IEA (2022), Nuclear Power and Secure Energy Transitions: From today’s challenges to tomorrow’s clean energy systems, OECD Publishing, Paris, https://doi.org/10.1787/aca1d7ee-en.

Uranium, https://tradingeconomics.com/commodity/uranium

US Energy Information Administration (2022), Nuclear explained: Where our uranium comes from, https://www.eia.gov/energyexplained/nuclear/where-our-uranium-comes-from.php

World Uranium Mining Production (2021), https://www.world-nuclear.org/information-library/nuclear-fuel-cycle/mining-of-uranium/world-uranium-mining-production.aspx

Civil Nuclear Credit Program, https://www.energy.gov/gdo/civil-nuclear-credit-program

This material does not constitute tax, legal, investment or any other type of professional advice. You should consult with a qualified tax, legal or financial advisor prior to making a decision. The financial instruments discussed in this brochure may not be suitable for all investors and investors must make their own investment decisions based upon their specific financial situations and investment objectives. Information has been obtained from sources believed to be reliable, but we do not guarantee their accuracy or completeness. While we have taken great care in the preparation of these materials, we cannot be responsible for clerical, computational, or other errors. Except where otherwise indicated herein, the information provided herein is based on matters as they exist as of the date of preparation and may not be updated or otherwise revised to reflect information that subsequently becomes available, or changes occurring after the date hereof.

Investment advisory services offered through Zeke Capital Advisors DBA Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training. Information about Sequoia can be found within Part 2A of the firm’s Form ADV, which is available at https://adviserinfo.sec.gov/firm/summary/117756

The tax and estate planning information offered by the advisor is general in nature. It is provided for informational purposes only and should not be construed as legal or tax advice. Always consult an attorney or tax professional regarding your specific legal or tax situation. Tax preparation is done by a 3rd party and not Sequoia Financial Group.

©2023, Sequoia Financial Group, all rights reserved.

FORWARD LOOKING STATEMENTS Certain of the statements set forth in this commentary constitute “forward-looking statements.” All such forward-looking statements involve risks and uncertainties, and there can be no assurance that the forward-looking statements included in this commentary will prove to be accurate. Considering the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as representations or warranties of Zeke Capital Advisors and that the forward-looking statements will be achieved in any specified time frame, if at all.

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

Markets Soar After 90-Day Tariff Pause