Markets Broadened and Hit New Highs

by Sequoia Financial Group

by Sequoia Financial Group

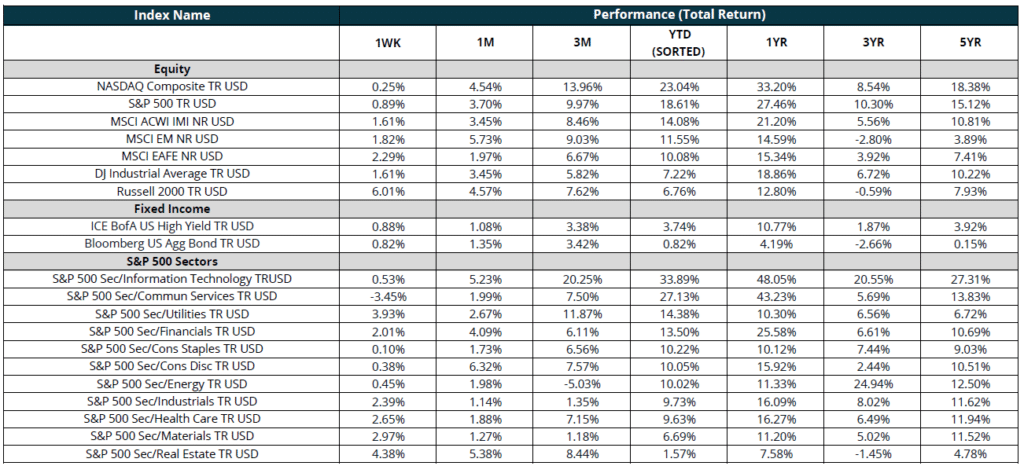

Both equity and fixed income indices ended the week in positive territory and most major equity indices posted new records during the week.

For the week, the Dow Jones Industrial Average posted strong returns of 1.61%, with the S&P 500 index advancing by 0.89% with the Nasdaq trailing with a return of 0.25%1. The week also saw an outsized gain in the S&P 500 Equal Weighted index relative to the market-cap weighted S&P 500 index, indicating a broadening out of the market with the equal weighted higher on the week by 2.93%1. The rise in the indexes were accompanied by a decline in the CBOE Volatility index, ending the week at 12.452.

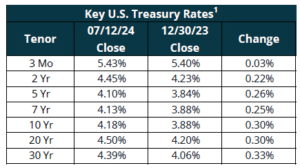

In fixed income markets, the Bloomberg US Aggregate Bond Index rose 0.23% as the US Treasury 10-year bond ended the week at 4.18%, down 10 bps and at its lowest level since March 12.3

Thursday’s release of June’s Consumer Price Index (CPI) sparked a broad rally in small caps and interest-rate sensitive stocks as traders bet that interest rate cuts were likely in September. The small-cap Russell 2000 Index rose 3.58% while the SPDR S&P Regional Bank ETF advanced 4.21%. However, these gains were at the expense of the high-flying technology sectors as the S&P 500 declined 0.87% and the NASDAQ fell 1.95%4.

The CPI declined 0.1% for the month, better than expectations for a 0.1% increase. For the trailing 12 months, the CPI rose 3%, down from May’s 3.3% reading. Gasoline declined 3.6%, more than offsetting an increase in shelter costs.5

Slightly tempering investor enthusiasm was a weaker-than-expected Producer Price Index (PPI) report for June. The PPI advanced 0.2%, with the prices for final demand services higher by 0.6% while prices for final demand goods fell 0.5%.6

Second-quarter corporate earnings also came into focus during the week. Among the large financials, Citigroup, Wells Fargo, and JP Morgan generated mixed results. Citigroup shares declined even as the bank reported better-than-expected Q2 results of $1.52 per diluted share, representing a 14.3% year-over-year increase, exceeding consensus estimates of $1.39/share7.

Shares of Wells Fargo (WFC) declined after the bank’s net interest income fell short of estimates. Net interest income, a key measure of the income the bank generates from lending, declined by 9% year-over-year to $11.9 billion, below the consensus estimate of $12.12 billion. The bank attributed this drop to the impact of higher interest rates on funding costs7.

Despite posting both earnings and revenue beats, JPMorgan shares also declined. The bank reported revenue of $50.99 billion, higher than the consensus forecast of $49.87 billion. The bank’s adjusted EPS of $4.26 also beat the consensus of $4.19. However, investors were disappointed in the higher-than-expected provision for credit losses, which indicates that the bank expects more borrowers will default on loans going forward.7

Earnings season has just begun, with 5% of S&P 500 companies reporting last week, but early results are promising: 81% of these have reported a positive EPS surprise and 56% have reported a positive revenue surprise. For Q2 2024, the blended (year-over-year) earnings growth rate for the S&P 500 is estimated at 9.3%.8

Sources:

- Morningstar Direct

- https://www.cnbc.com/quotes/VIX?qsearchterm=vix

- https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value=2024

- https://www.cnbc.com/2024/07/10/stock-market-today-live-updates.html

- https://www.bls.gov/news.release/pdf/cpi.pdf

- https://www.bls.gov/news.release/ppi.nr0.htm

- https://www.cnbc.com/2024/07/12/stocks-making-the-biggest-moves-midday-wfc-jpm-t-and-cvna.html

- https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_071224.pdf

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

Markets Soar After 90-Day Tariff Pause