Quick Rebound for Stocks Doesn’t Mean an End to Volatility

by Sequoia Financial Group

by Sequoia Financial Group

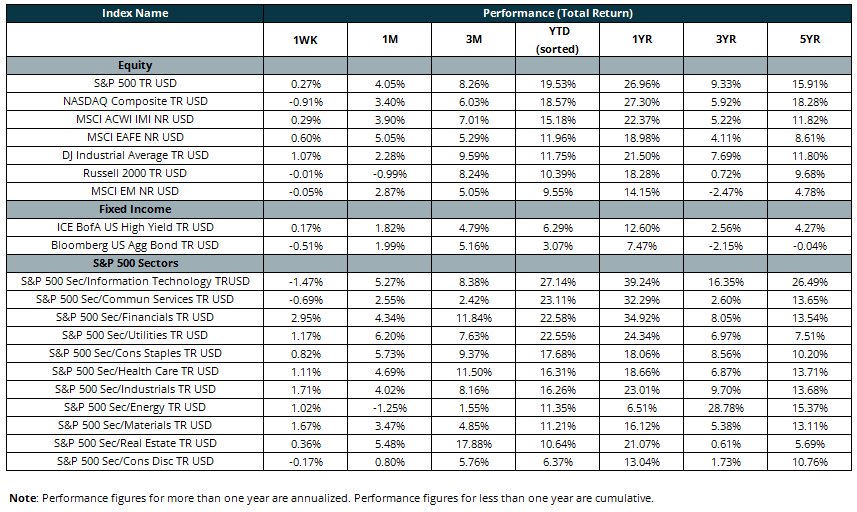

August took investors on a wild ride. The month started with the Dow Jones Industrial Average and the S&P 500 registering their largest daily losses since September 2022. Meanwhile, the NASDAQ slid into correction territory, losing more than 10% from its recent high in July. The losses were driven by renewed recession concerns and the reversal of a Japanese “carry trade.” Fortunately, stocks recovered the lost ground, thanks partly to cooling inflation, stronger economic reports, and comments from Fed Chair Powell that signaled interest-rate cuts would begin in September. The major averages all eked out gains for the month, with the S&P 500 scoring its fourth winning month in a row[1].

The final week of August brought a much-anticipated earnings report from NVIDIA. NVIDIA, now the third largest company in the world based on market capitalization and the dominant AI chip provider, was set to deliver arguably the most critical report of the earnings season. And the report nearly lived up to expectations. NVIDIA’s revenue and income more than doubled year-over-year, with both besting analyst estimates[2]However, the stock sold off following the report, as revenue growth slowed slightly and margins narrowed slightly. The stock dipped 6.5% on Thursday but ended the week still up 140% since the beginning of the year.

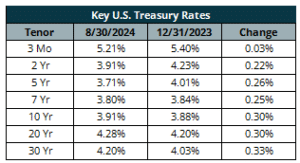

Surprisingly, NVIDIA’s earnings report did little to slow the market’s recovery. The closely watched personal consumption expenditure, the Fed’s favored inflation measure, came in Friday at just 0.2% for the month, in line with market expectations[3]. The modest increase provided further support for the Fed to cut rates at its September meeting and helped the major stock market averages end the week on a high note.

However, investors should brace for continued volatility. Historically, September is the worst-performing month for the stock market. And that holds in presidential election years. Dating back to the 1940s, stocks have lost an average of 0.70% in September[4]. That number climbs to 0.80% during election years[5]. We’ll start the month focused on the job market, but the big news will come September 18 when the Fed is expected to cut rates for the first time since March 2020.

[1] https://www.cnbc.com/2024/08/29/stock-market-today-live-updates.html

[2] https://www.cnbc.com/2024/08/28/stock-market-today-live-updates-.html

[3] https://www.cnbc.com/2024/08/29/stock-market-today-live-updates.html

[4] https://www.inc.com/phil-rosen/stock-market-economic-outlook-recession-jobs-equities-investors-rate-cuts.html

[5] https://www.marketwatch.com/story/the-2024-presidential-election-is-entering-its-most-volatile-period-for-the-stock-market-50a34b72

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

End to Shutdown Overshadowed by Rate-Cut Concerns