A Merry Christmas with a Santa Claus Rally?

by Sequoia Financial Group

by Sequoia Financial Group

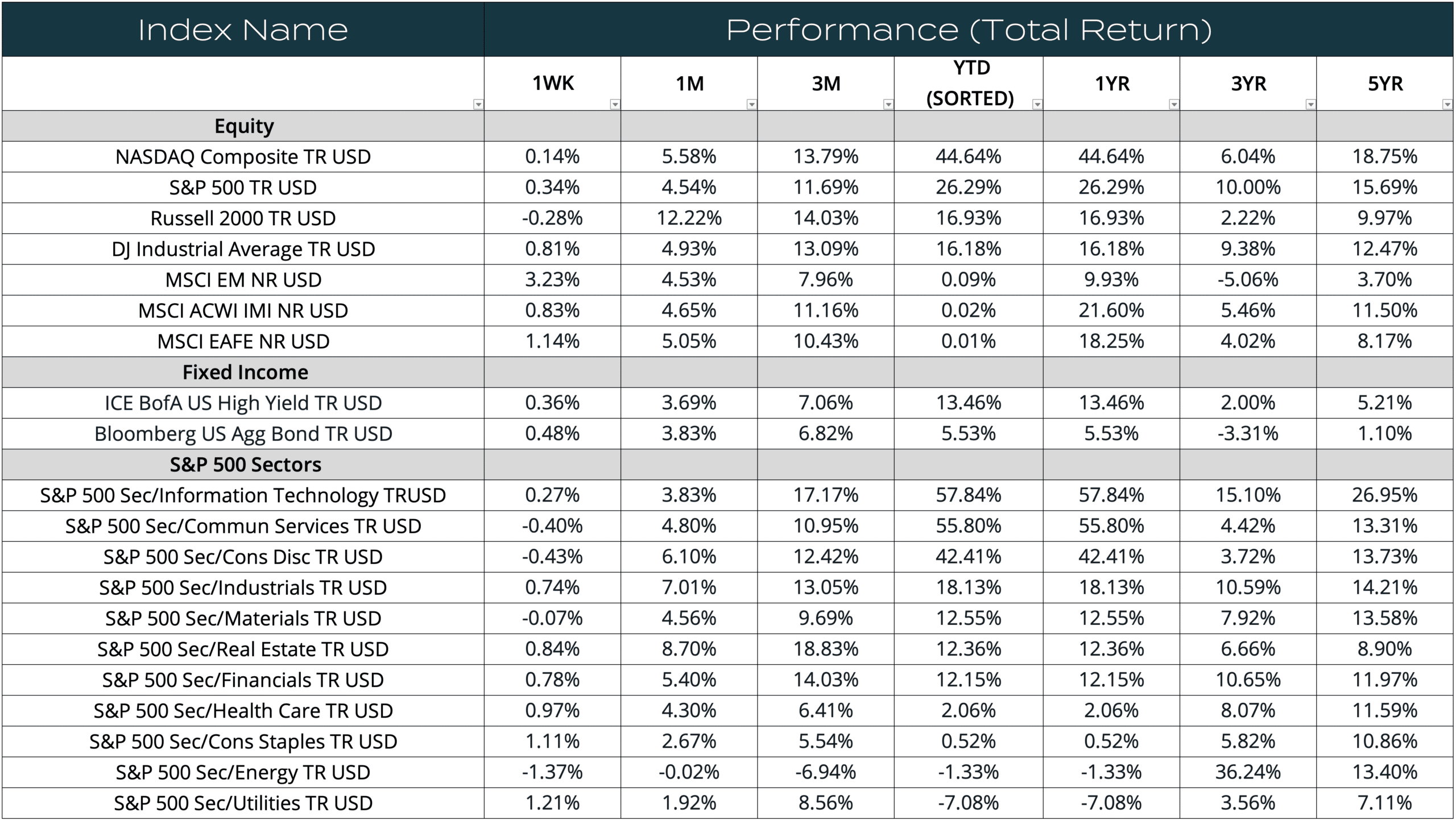

Investors and traders closely monitored the US equity markets last week in the hope that they would be recipients of investment gains courtesy of a “Santa Claus rally”. The moniker refers to the tendency of stocks to get a bump over the last five trading days of the year and the first two of the next[1]. The S&P 500 has traded higher about 79.5% of the time during that period for an average gain of 1.4% since 1950, according to Dow Jones Market Data. Over the first five days of the period so far, the S&P 500 is on pace to add 0.8%, while the NASDAQ is on track to jump 0.96%. The Dow Jones Industrial Average is on course to gain 0.8%[1].

While US equities fell slightly on Friday, the S&P 500 Index ended 2023 with an unexpected gain of 26% as the economy remained strong, inflation slowed, and the Federal Reserve indicated that its interest rate-hiking campaign may be at an end. The S&P 500 rose for nine straight weeks to end the year, its best winning streak since 2004. Big Tech stocks lifted the NASDAQ to a return of 44.6%, its best year since 2020, on AI-related buying enthusiasm for likes of Nvidia and Microsoft. The Dow finished the year with a 16.1% gain, just below the record high it reached on Thursday.

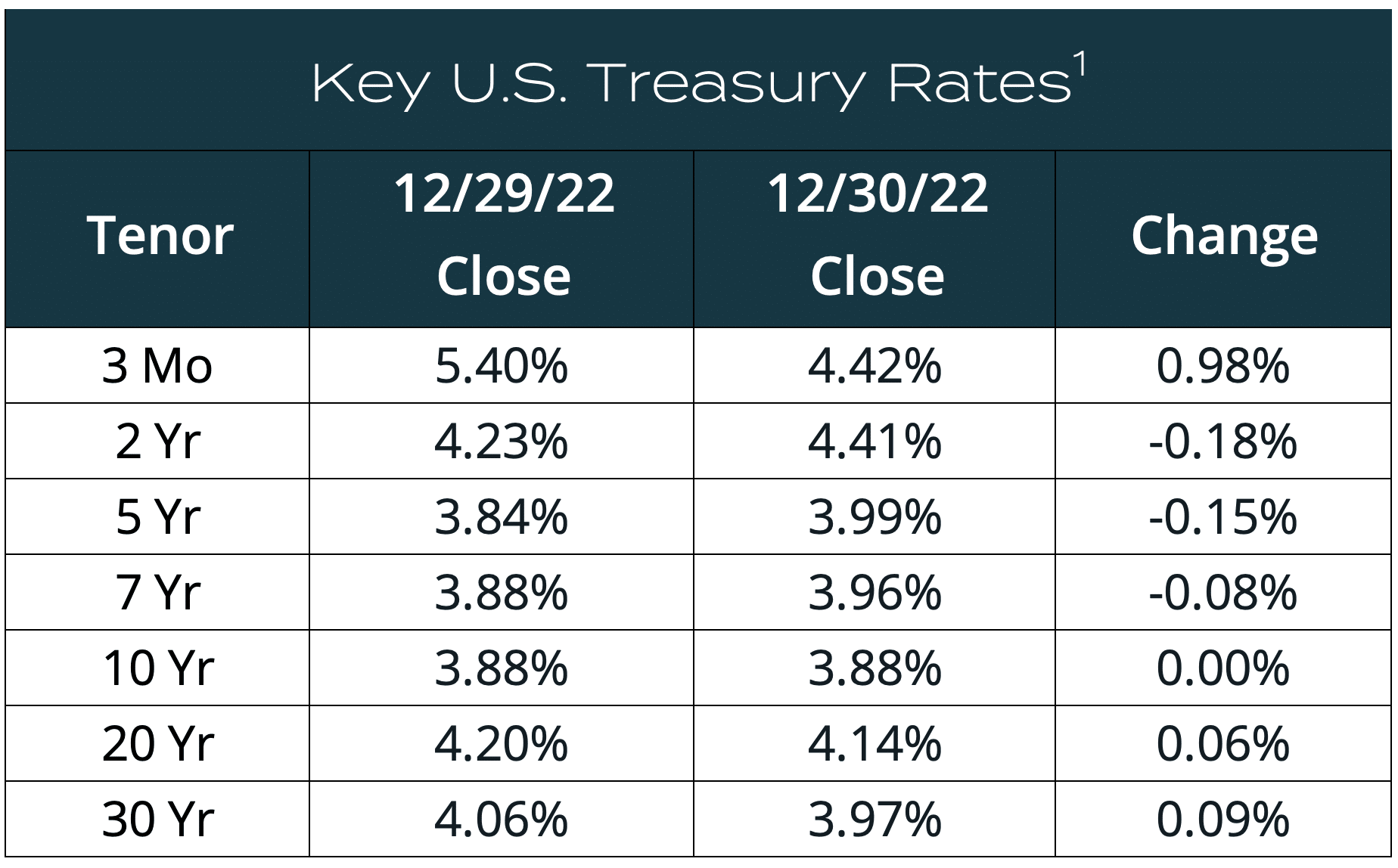

Fixed income markets also saw somewhat of a rebound late in the year as the US 10-year Treasury bond ended the year at 3.88%, down from its mid-October peak of 4.98%.[2] The Bloomberg US Aggregate Bond Index rose 5.53% for the year.[3]

The impact of declining interest rates was also felt in the currency markets as the US Dollar Index last week hit its lowest level since July. For the year, the Index is down more than 2% and recorded first negative year since falling 6.7% in 2020. Elsewhere, the Euro is up 3.4% against the dollar in 2023, racking up its best year since 2020 when it jumped nearly 9%.[4]

Last week was also the end of the financial year. As we head toward Q4/23 corporate earnings season, early results indicate that companies are experiencing difficulties in meeting revenue expectations but are exceeding earnings expectations. The estimated revenue growth rate for the S&P 500 Index in Q4/23 is 3.1% year over year, with earnings growth of 2.4%. Looking ahead, analysts are calling for full-year earnings expansion of 11.5% year over year in 2024.[5]

Given that the S&P 500 Index is within 1% of a new record, consensus thinking is that the Index is expensive. From a valuation perspective, the forward 12-month P/E ratio for the S&P 500 Index is 19.3x, which is above both the 5-year average (18.8x) and the 10-year average (17.6).5

[1] https://www.wsj.com/livecoverage/stock-market-today-dow-jones-12-29-2023/card/the-santa-rally-is-ringing-in-another-new-year-RxSDL7hcM97HIygcXnYs

[2] https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value=2023

[3] Morningstar Direct

[4] https://www.cnbc.com/2023/12/26/stock-market-today-live-update.html

[5] https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_121523.pdf

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

Fed Chair Powell’s Tariff Talk Spooks Already-Nervous Markets