The Goldilocks Rally Rolls On

by Sequoia Financial Group

by Sequoia Financial Group

With third quarter earnings and the presidential election in the rear-view mirror, last week the financial markets turned their attention to the economy. Thus far in 2025, the economy has grown at a measured pace that has allowed inflation to fall and corporate earnings to climb – a so-called Goldilocks economy.[1] But signs of economic weakness could spook investors looking for higher earnings to fuel further stock price gains in 2025. Meanwhile, added economic strength could signal a new round of inflation and fewer interest-rate cuts by the Federal Reserve.

Thankfully, the latest reports on manufacturing and jobs came in just right. US manufacturing showed improvement in November, with the manufacturing Purchasing Managers Index climbing 1.9 points to 48.4. The overall reading remained in contraction territory (below 50), but the rate of contraction slowed, and the New Orders Index flipped from contraction to expansion (above 50).[2] The modest improvements were cheered by stock investors, with the S&P 500 and the NASDAQ closing last Monday at record levels.[3]

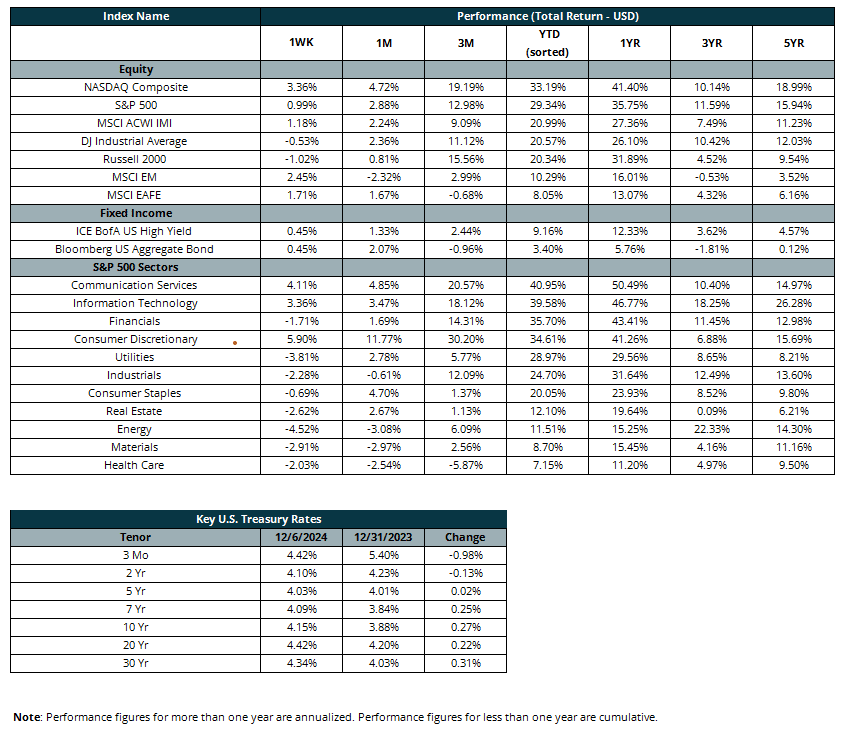

The jobs report released on Friday was met with similar enthusiasm. The economy added slightly more jobs than expected, and October’s job growth was revised higher. As expected, the unemployment rate edged up slightly to 4.2%.[4] Taken together, the numbers were seen as a green light for the Fed to cut interest rates by a quarter percentage point at its meeting on December 18. Odds of a cut jumped to 86% from 66% a week prior.[5] And the S&P 500 and the NASDAQ reached record levels yet again, with stocks closing Friday on a three-week winning streak.4

Meanwhile, bond prices, which move inversely to bond yields, moved slightly higher last week. The encouraging jobs report pushed the 10-year Treasury yield to its lowest level since October 18.[6] And, like stocks, bonds enjoyed their third winning week in a row.

Looking ahead, we’ll get a smattering of earnings reports this week, most notably from Broadcom, Costco, and Ciena. On the economic front, we’ll get November CPI and PPI inflation readings, and initial and continuing jobless claims. These reports could hold added sway with the Fed and cause increased market volatility, as they will be among the final economic indicators for Federal Reserve Chairman Powell to consider heading into the December Fed meeting.

[1]https://en.wikipedia.org/wiki/Goldilocks_economy#:~:text=A%20Goldilocks%20economy%20is%20an,Goldilocks%20and%20the%20Three%20Bears.

[2] https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/november/

[3] https://www.cnbc.com/2024/12/01/stock-market-today-live-updates.html

[4] https://www.cnbc.com/2024/12/05/stock-market-today-live-updates.html

[5] https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html?redirect=/trading/interest-rates/countdown-to-fomc.html

[6] https://www.marketwatch.com/story/treasury-yields-mostly-higher-ahead-of-november-jobs-data-ac0e2375

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

Fed Chair Powell’s Tariff Talk Spooks Already-Nervous Markets