Weak Economic Data Roiled Equity Markets

by Sequoia Financial Group

by Sequoia Financial Group

Volatility returned in a holiday-shortened trading week as weak economic data raised investor concerns of a slowing economy, resulting in a significant sell-off.

The averages tumbled on Tuesday as investors dumped tech stocks on the back of a weaker-than-expected reading of 47.2 from the ISM Manufacturing Survey. A reading of less than 50 indicates the manufacturing sector is contracting, and a decline in the New Orders component suggested further weakness was likely.1 Equity markets ended the day lower, with the NASDAQ index down 3.26% and the S&P 500 off by 2.11%.2

The NASDAQ and S&P 500 extended their declines on Wednesday as job openings slumped to their lowest level in three-and-a-half years in July in another sign of slack in the labor market. The Labor Department’s closely watched Job Openings and Labor Turnover Survey (JOLTS) showed that open positions fell to 7.67 million on the month, off 237,000 from June’s downwardly revised number and the lowest level since January 2021. Economists surveyed by Dow Jones had been looking for 8.1 million.3

Stocks continued to struggle on Thursday as investors dumped risk assets and concerns mounted over the outlook for the U.S. economy ahead of Friday’s keynote labor report. Fresh labor market data on Thursday sent mixed signals about the health of the U.S. economy as questions linger over whether the Federal Reserve is behind the curve on rate cuts. Private payroll data showed the weakest growth since 2022, heightening fears of a slowing labor market. However, weekly claims for unemployment benefits declined from the previous week.4 The S&P 500 Index posted another daily loss.

The declines in the financial markets were exacerbated on Friday following the release of the latest labor data. According to the Labor Department’s Bureau of Labor Statistics, nonfarm payrolls expanded by 142,000 during the month, up from 89,000 in July and below the consensus forecast of 161,000 from Dow Jones. However, more concerning was that the previous two months saw substantial downward revisions: the BLS cut July’s total by 25,000, while June was revised downward by 61,000 to 118,000.5

Adding to concerns was wage data, which showed average hourly earnings increased by 0.4% on the month and 3.8% from a year ago, both higher than the respective estimates of 0.3% and 3.7%. Meanwhile, the unemployment rate ticked down to 4.2%, as expected.5 The weakness in job creation suggests the US economy is slowing and an easing of monetary policy is warranted.

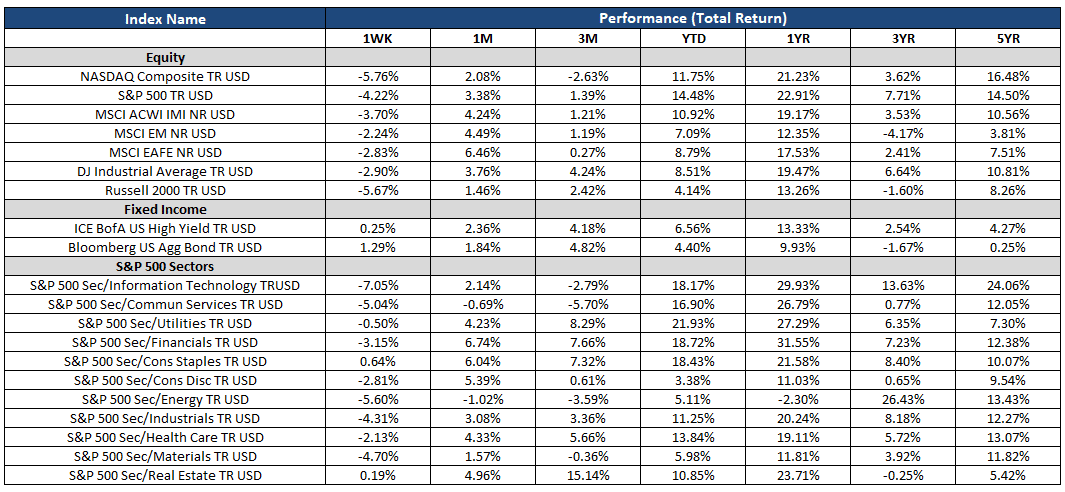

By the end of the week, all major indices had posted significant declines. The technology-heavy NASDAQ fell 5.76%, the S&P 500 Index shed 4.22%, and the Dow Jones Industrial Average dipped 2.90%. Small-cap stocks fared poorly as well, with the Russell 2000 Index lower by 5.67%. International equity markets were also not immune to weakness, with the MSCI EAFE Index down 2.83%.6

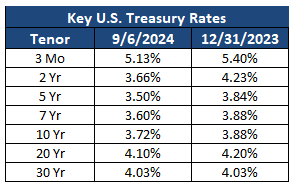

The exodus of capital from the equity markets resulted in a flight to safety into fixed income. The US Treasury yield curve shifted lower across all maturities given investor concerns over the economy. The US Treasury 10-year bond ended the week at 3.72%, down 20 bps from the prior week and at the lowest level since June 2023.7 The Bloomberg US Aggregate Bond Index ended the week 1.29% higher.8

During the week, the fixed income markets saw the relationship between the 10- and 2-year Treasury yields briefly normalized on Wednesday, reversing a classic recession indicator. Following economic news that showed a sharp decline in the JOLTS data and dovish remarks from Atlanta Fed President Raphael Bostic, the benchmark 10-year yield inched above the 2-year for the first time since June 2022.9 However, the relationship between the three-month T-bill yield and the 10-year Treasury bond yield remains inverted by 141 bps.10

Sources:

- https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/august/

- Morningstar Direct

- https://www.cnbc.com/2024/09/04/jolts-july-2024.html

- https://www.cnbc.com/2024/09/04/stock-market-today-live-updates.html

- https://www.cnbc.com/2024/09/06/jobs-report-august-2024.html

- Morningstar Direct

- https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value=2024

- Morningstar Direct

- https://www.cnbc.com/2024/09/04/bond-market-yield-curve-returns-to-normal-from-inverted-state-that-had-raised-recession-fears.html

- https://fred.stlouisfed.org/series/T10Y3M

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

Fed Chair Powell’s Tariff Talk Spooks Already-Nervous Markets